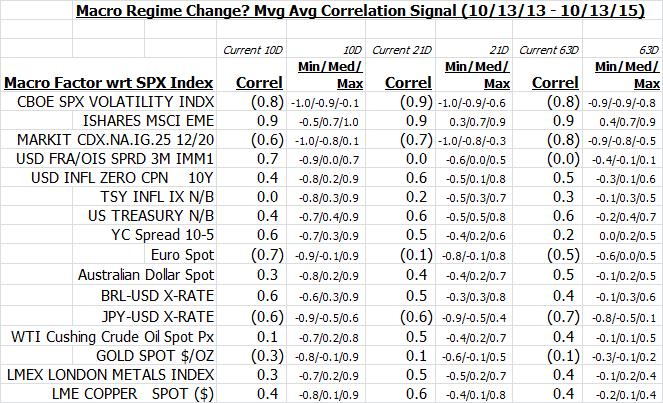

Notables (wrt SPX):

• equity: VIX ST correlation firmly –ve, near traditional unit inverse; EEM correlation decisively +ve

• rates & credit: IG CDS ST correlation distorted to modestly –ve, on index roll, vs. normal mirror inverse boundary hug; OIS/Libor liquidity barometer ST correlation uncharacteristically moderately +ve; E(inflation) ST correlation falls to marginally +ve, real rates near correlation random zone, nominal rates ST correlation remains tepidly +ve & 10-5 YC spread ST correlation stays modestly +ve

• currency: pro-growth currencies: EUR ST correlation still moderately -ve, AUD ST correlation a hint +ve & BRL ST correlation modestly +ve; JPY near correlation sticks modestly -ve

• commodity: crude ST correlation lower at random; Au ST correlation sign change to a glimmer -ve; LMEX ST correlation lower at a sliver +ve; Cu ST correlation falls to weakly +ve

The pdf file link below, and synopsis above, may help serve as an additional gauge on the macro risk factor analysis dashboard.

Macro regime change MA correl.pdf

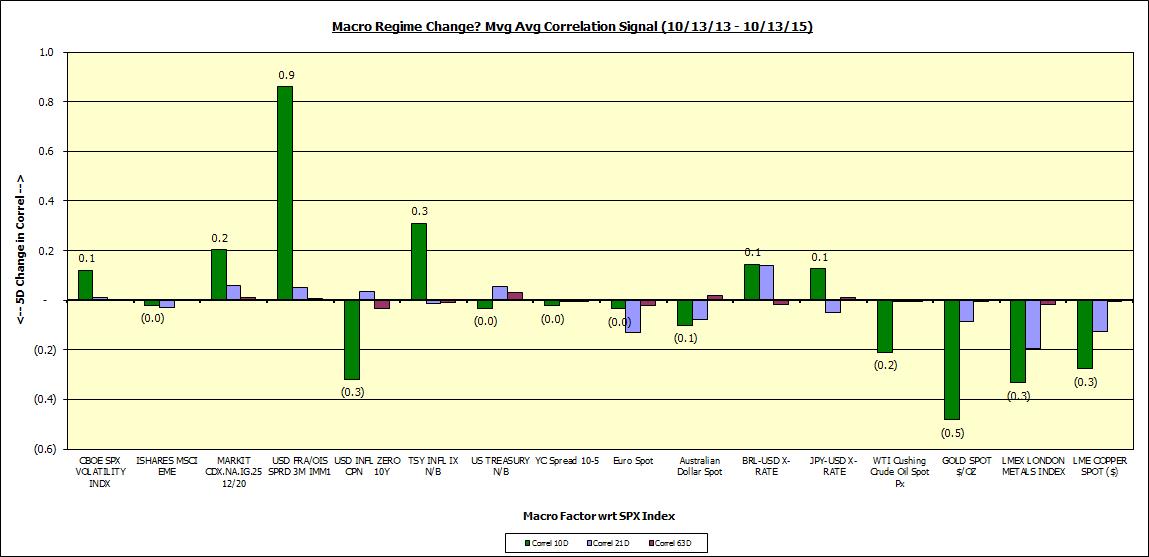

Using 2y trailing data, shown are the 2w, 1m & 3m moving average correlation of the SPX daily returns to a variety of macro factors across the equity, rates & credit, currency and commodity asset-class spectrum. Also displayed is the current correlation structure, along with min/median/max thresholds, to help provide contextual reference, as a supplement to the pictorial representation.

The 2w correlation is exceedingly whippy, statistically insignificant, risks chasing ghosts and highlighting false signals and coincidental correlations, the 1m correlation less so and the 3m correlation has more gravity but is a little slower in incorporating the most recent data. At the risk of false +ve/false –ve signals, the potential confidence in inflexion points/regime changes may increase when all three gauges directionally, and with meaningful magnitude, move the same way.

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors