Punch line: The following is an attempt to use the insights from option pricing and delta-neutral hedging to help provide a guide for drawdown-based portfolio exposure management.

By way of introduction, funds often have a stop-loss discipline in place at the individual stock level; both absolute as well as relative to portfolio impact. Also, in order to address the historical cost-based artifacts of this measure, it is frequently supplemented with a short-term price-change framework that looks at the recent price behavior of stocks, both on a discreet and volatility-scaled basis, as well as their short-term drawdown and clawback.

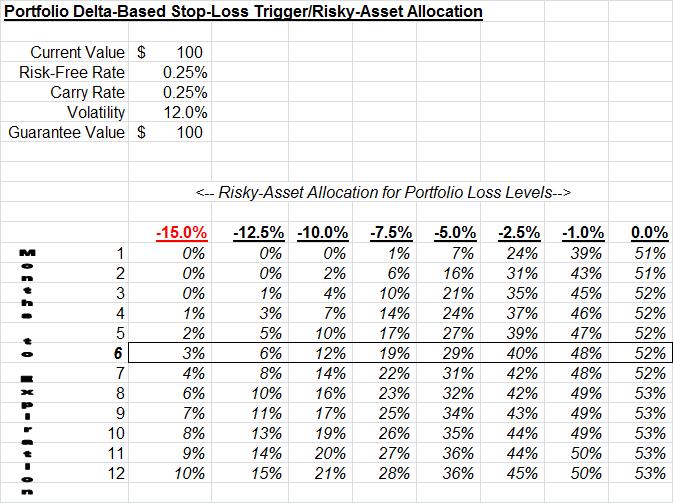

However at the portfolio level it is still possible to experience significant drawdown even if one were to rigorously adhere to the stock-level stop-loss safeguard. Using a back-of-the-envelope rule of thumb, if a funds volatility target is 12% the minimum worst-case monthly drawdown might realize ~ 7% (2-sigma monthly event). A funds innate capital-preservation predilection might cause it to temper net/gross exposure before that loss level was broached, hopefully staunching portfolio losses to a more modest level.

A wing and a prayer aside, can we use the insights of a dynamic asset-allocation framework to help serve as a quantitative guide, as opposed to relying on ad-hoc and discreet qualitative loss levels, to rein in portfolio-level exposure?

It is helpful to think of the solutions used by principal-guarantee providers as they are essentially faced with a similar issue. In general there are two primary structures. The first, which is very inefficient as it results in a minor allocation to the risky asset (particularly for short maturities in a low-rate environment), is to defease the principal-guaranteed amount with zero-coupon bonds, thereby guaranteeing the principal amount at maturity, and placing the difference in the risky asset.

The other more efficient structure relies on option-pricing and delta-neutral hedging insights (similar to portfolio insurance), by trying to replicate a call-option profile that is struck at the principal-guaranteed amount. As the portfolio value dips below the “strike” the allocation to the risky asset is dynamically reduced (and risk-free asset commensurately increased) and vice versa, thereby providing a hedging prescription that is designed to ensure that the composite portfolio >= principal-guaranteed amount (less the cost of whipsaw/option creation) at maturity.

The table below attempts to illustrate this by enumerating the % delta (i.e., risky asset exposure) for various loss levels and maturities. The shorter the maturity horizon, the more draconian the curtailing in risky asset allocation for a given loss level, as there is less time to potentially recover. Additionally, in practice, the relative changes in exposure allocation may be more meaningful rather than the absolute levels, i.e., an xx% reduction in exposure, relative to neutral, for a given level of portfolio loss.

Proprietary and confidential to Risk Advisors