Punch line: given the recent sector-based wobbles I took a deep dive into historical sector realignment during phases of healthcare under-performance. In general, cyclical sectors have tended to benefit from a rotation out of healthcare which has also been typically associated with a rise in UST10y yields.

Given the recent sector-based wobbles I took a deep dive into historical sector realignment during phases of healthcare underperformance. Specifically, during large drawdown episodes of healthcare relative performance, which sectors consistently stood to benefit from rotation away from healthcare.

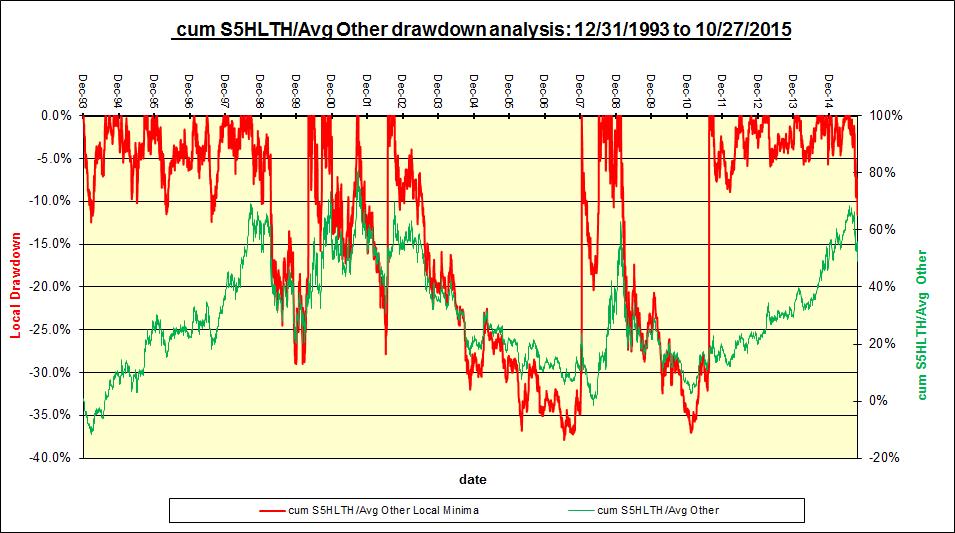

Mechanically, I looked at the top 10 drawdowns in the cumulative performance of the S&P500 healthcare sector relative to the cumulative average performance of all other sectors (excluding lightly-trafficked utilities and telecom services) and used a modified high-water mark to address drawdown trap. This is reflected in the chart below. The red line that traces relative drawdown episodes (left y-axis) reveals that several were fairly protracted and quite severe. The green line that charts cumulative healthcare over “other-”sector relative-return (right y-axis) very broadly follows a low frequency, high amplitude lazy wave that troughs flattish and crests between 70-80%.

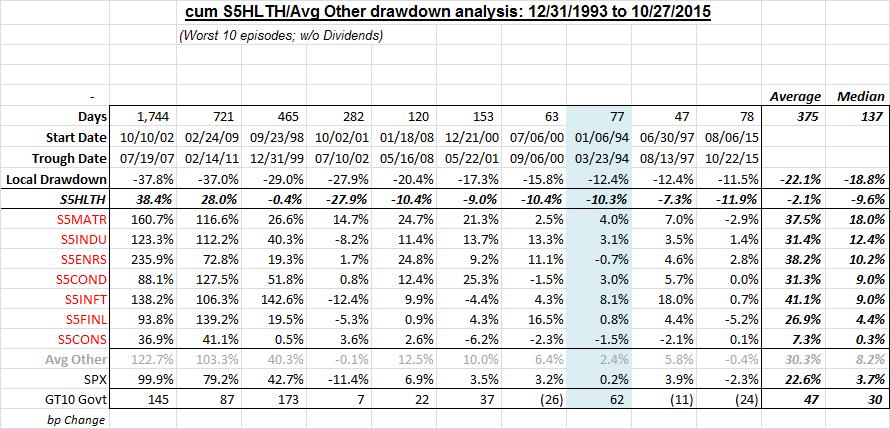

The following table zooms into the sector entrails underlying the top 10 relative-return drawdown episodes. Shown are the drawdown dates, magnitude of relative-return drawdown, healthcare and “other” sector returns (“other” sectors ordered by median return), SPX return and bp change in UST10y yield. For instance, the 1994 drawdown episode (highlighted in pale blue) lasted 77days starting 01/06/1994 and bottoming 03/23/1994, experienced a relative-return drawdown of -12.4%, where healthcare fell -10.3% and “other” sector returns ranged from a high of 8.1% for info tech and a low of -1.5% for consumer staples, with a flattish overall SPX return and a 62bp increase in UST10y yields.

In general, cyclical sectors have tended to benefit from a rotation out of healthcare which has also been typically associated with a rise in UST10y yields. Reference the latest healthcare relative-return drawdown, political backdrop aside, further damage might be arrested if long rates are biased lower because of external weakness and the gravitational pull of QE-induced lower foreign rates; and may persist if US growth gathers steam and is transmitted into a firmer rate structure. Finally, financials which have traditionally traded as classical long-duration assets, have been trading with rates given the risk-premium regime of the last several years; hence they may provide a rate-based risk-mitigating hedge to the healthcare sector if one is favorably disposed to both sectors.

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors