Punch line: using an algorithm to isolate HFR’s hedge fund strategy indices experiencing the greatest local relative-return rally, sequentially folding backwards from today, reveals that HFRI convertible arbitrage index has returned 99% vs.39% for the HFRI weighted composite index over the latest “ascendancy” episode lasting ~5 years.

The following analysis chronicles the time-wise ascendancy of HFR’s hedge fund strategy indices over the last 25 years using a dynamic, path-dependent, fold-back methodology (using a modified low-water mark to avoid “ascendancy-trap” and prod strategy rotation).

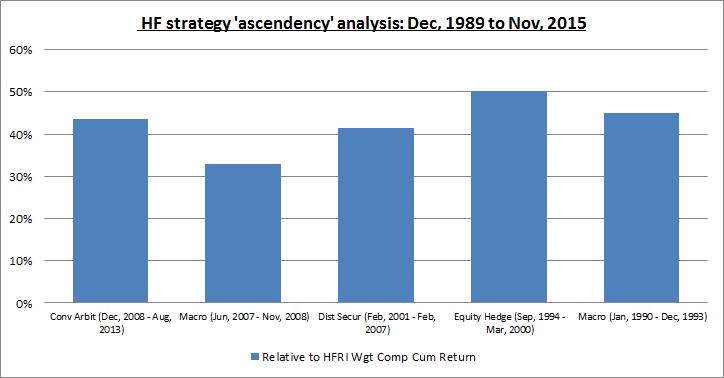

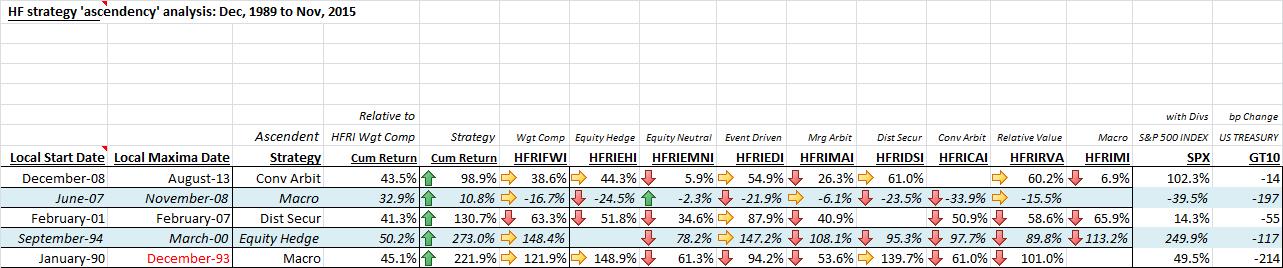

The algorithm starts at the latest date and surveys HFR’s hedge fund strategies to identify the “ascendant” strategy that has experienced (is experiencing) the greatest local relative-return rally maxima (relative to the HFRI weighted composite index); it details the magnitude of the rally, from its local start date to its local maxima date, along with returns of all other HFRI strategies and commensurate SPX returns and change in UST10y yields. It then folds back to the “ascendant” strategies local start date and repeats the procedure based on the magnitude of the then prevalent local relative-return rally strategy maxima’s; and so it folds all the way back to 1990. The time-wise “ascendant” strategies are reflected in the chart below (reverse chronology):

By way of an example, HFRI convertible arbitrage index is the latest ascendant strategy, whose outperformance phase commenced in Dec, 2008 and peaked in Aug, 2013. It achieved a relative excess return of 43.5% vs. the HFRI weighted composite index, by returning 98.9% vs. 38.6% for the HFRI weighted composite index. Reading across the row displays HFRI index returns for all other strategies along with commensurate SPX returns and change in UST10y yields. (Please review pdf link below for magnified detail.)

A few high-level comments gleaned from the analysis:

- HFRI macro index was the best, and only +ve, hedge fund strategy straddling the GFC period. It returned 11% with the next best strategy, equity market neutral, returning -2% and the worst, convertible arbitrage (which subsequently rebounded to assume the latest ascendant strategy perch), returned -34% over this period

- HFRI equity hedge (L/S) index reaped a gain of 273% over its ascendency episode which started towards the latter half of the 1994 rate hikes and ended with the Y2K tech implosion. The next best strategy, event driven, rose 147%. It even bested the SPX which returned 250% over this period.

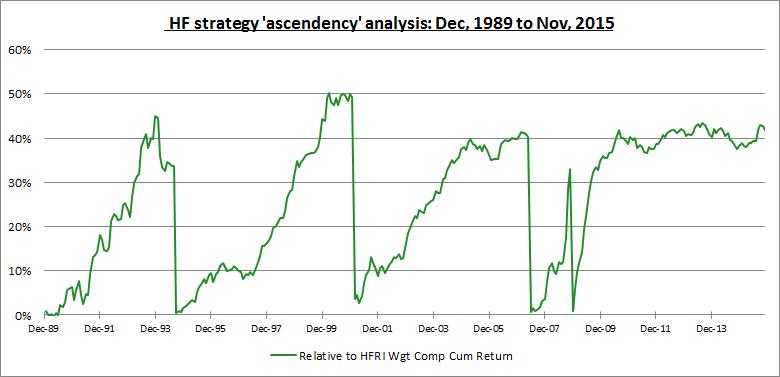

- as illustrated in the chart below, most of the HFR hedge fund strategy ascendency episodes were multi-year affairs and had a largely similar magnitude of local relative-return rally maxima, save the staccato macro index relative-return burst around the GFC period

- additionally, the chart reveals that the current ascendant strategy, HFRI convertible arbitrage index, has been muddling along its local relative-return rally maxima for a few years now

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors