Punch line: Q4, 2015 SPX sector returns rebounded from the prior quarter’s bloodletting. Sector returns, although barely for energy and utilities, were all in the green. Intra-sector stock returns exhibited mixed vol-scaled dispersion: highly dispersed in consumer staples and materials and well correlated in financials and utilities. These are reflected in the charts and tables below.

The following is an updated sector-level dispersion analysis, for Q4, 2015, which illustrates the rebound from the previous quarter’s drubbing:

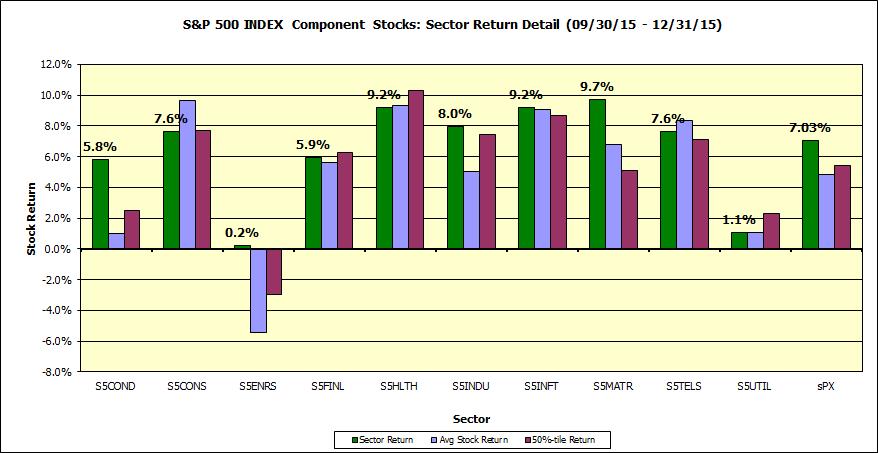

This first chart notes the sector (cap-weighted) return (green bars), average (equally-weighted) return (blue bars) and median stock return (burgundy bars) for the various sector of the SPX over the Q4, 2015 horizon (with dividends, latest constituents). Sector returns, although barely for energy and utilities, were all in the green. At the index level, cap-weighted returns bested equally-weighted returns reflecting large-cap bias.

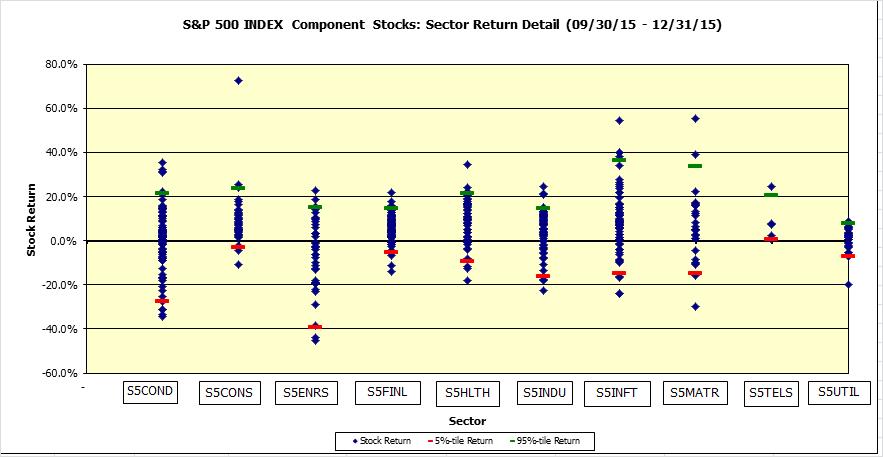

Next, a scatter plot of stock returns by sector, along with 5%- & 95%-tile markers, reflecting the mixed intra-sector stock dispersion; visually evidenced via the scrunched financials, and spaced-out materials, dot plot.

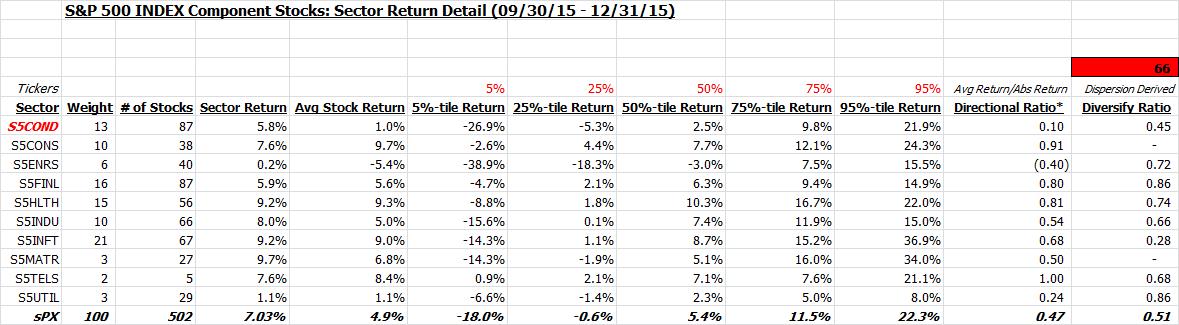

This is also shown in tabular form along with %-tile sector return distribution. Also shown is the directional ratio (avg net return to avg gross return), highlighting sector returns biased green, save energy, and dispersion-based diversification ratio which points to the mixed intra-sector stock-specific vol-scaled dispersion: highly dispersed in consumer staples and materials and well correlated in financials and utilities.

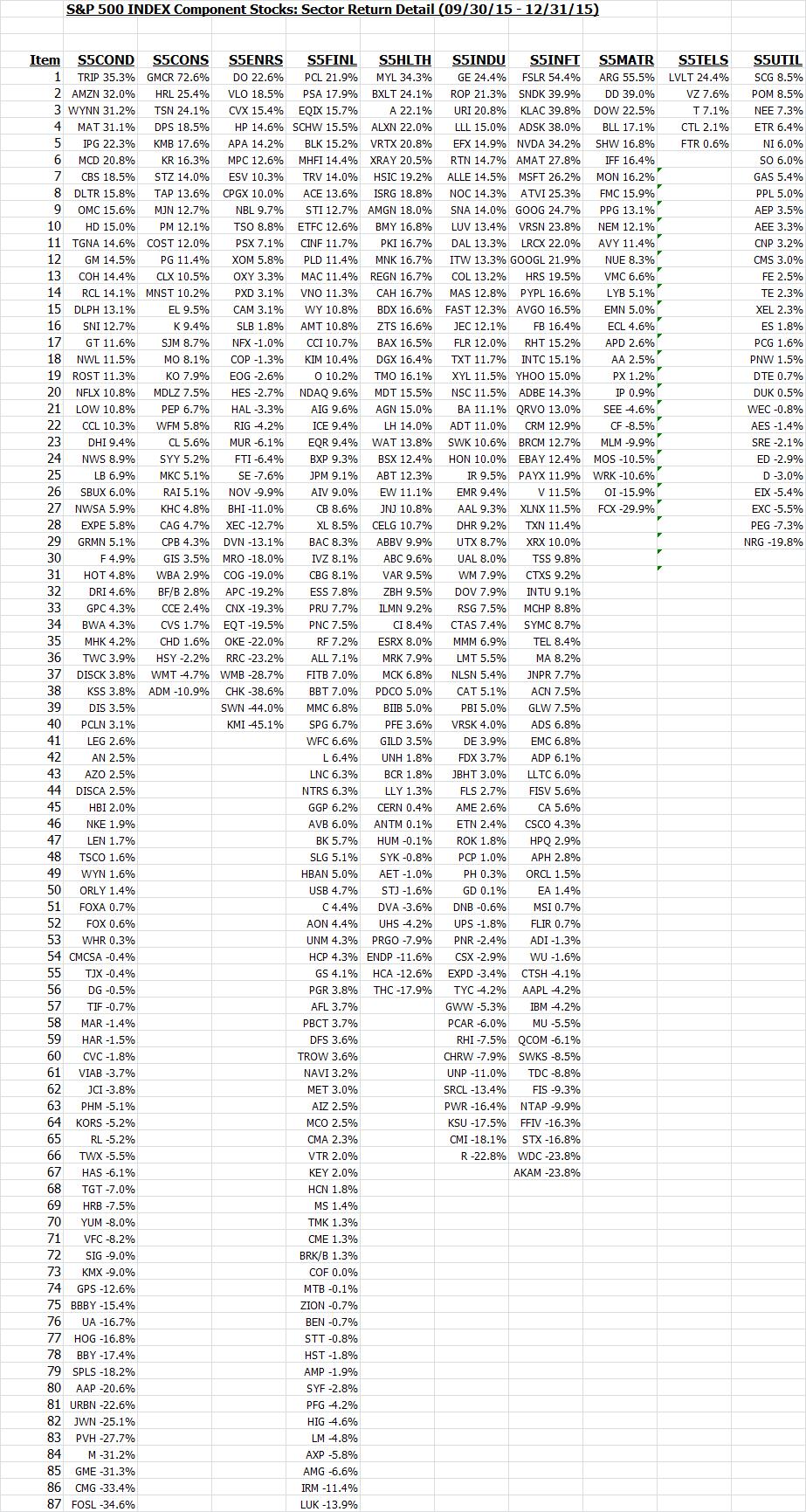

Finally, a listing of stock returns, by sector, ranked in descending order of performance:

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors