Punch line: given the potential for systemic fragility in the wake of Brexit, notwithstanding the possibility of containment, I looked at the most onerous episodes of a cross asset-class, Europe-driven contagion barometer, which spilt over into the US, and the resultant macro asset-class and SPX industry responsiveness. Per intuition, the most –vely exposed SPX industries included: diversified financials; auto & components; tech hardware & equipment; semis & semi-cap equipment; and banks. On the other side of the coin: utilities; food, beverage & tobacco; household & personal products; food & staples retailing; and consumer services, relatively held up the best.

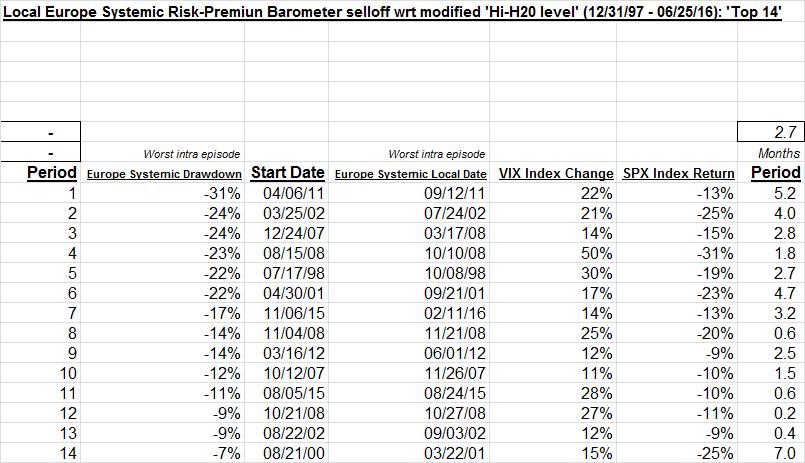

Given the potential for systemic fragility in the wake of Brexit, notwithstanding the possibility of containment, I resurrected a cross asset-class, Europe-driven contagion barometer (1/1/1998 to date; subject to a modified high-water mark) that also triggered contagion across the Atlantic. The systemic contagion barometer includes: equities (SX5E), volatility (V2X), rates (5y Bund), currency (JPY) and commodity (gold). To reflect contagion transmission into the US, and restrict it to periods of extreme stress, I only selected episodes conditional on SPX returning <= -7.5% and VIX absolute level rising >= 10%; this yielded 14 systemic-stress episodes which are shown below:

Shown in the pdfs below are the return/change statistics for a variety of macro asset-classes and SPX industries (w/o divs), along with median and hit-rate metrics. The message largely hues to intuition with the magnitude of the industry response largely colored by cyclicality.

Europe systemic risk-premium barometer MACRO PDF

Europe systemic risk-premium barometer INDUSTRY PDF

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors