Punch line: Underscoring Mark Twain’s quote, “history doesn’t repeat itself, but it does rhyme,” the following is a comment from an early 2014 post: the recent disfigurement in the factor complexion of the market has a common high-level thread (“Venn” intersection) running through it: popular crowded stocks, particularly amongst the leveraged community, that had high price momentum, sported lofty valuations and/or hyper growth prospects, which were largely in the biotech and internet space, were the victims of a severe mauling.

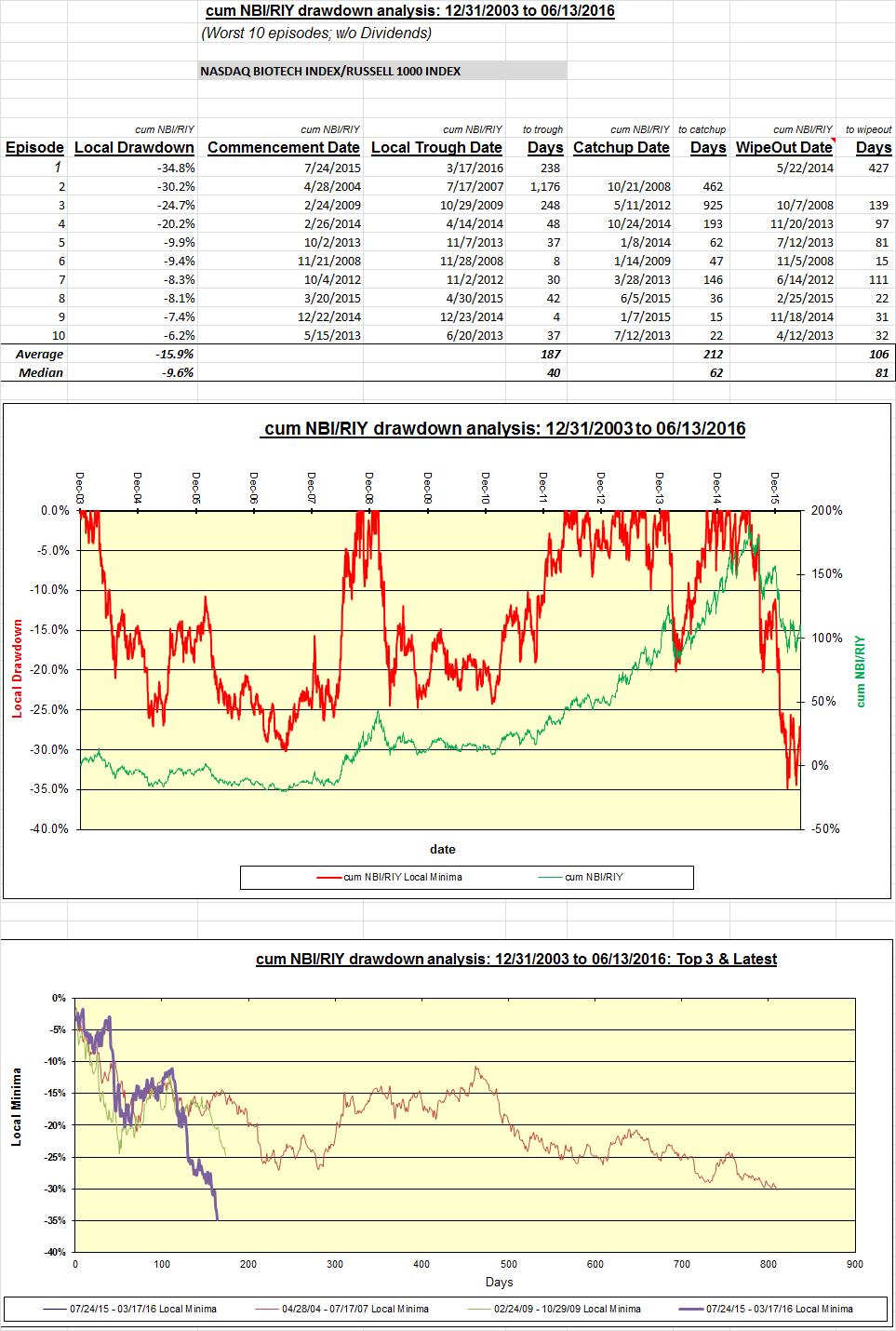

The attached updated analyses of representative indices illustrate the drawdown experienced and puts them in a historical context (1/1/2004 to date). Illustrated for the NBI – R1K excess return below, and included in pdf form, are analyses for:

NBI – R1K factor drawdown analysis_NBI_R1K

NDX – R1K factor drawdown analysis_NDX_R1K

R2K – R1K factor drawdown analysis_R2K_R1K

GS HF VIP – R1K factor drawdown analysis_GSHFVIP_R1K

R1K Growth – R1K Value factor drawdown analysis_R1K_Growth_Value

Shown are the drawdown returns, the commencement date of the drawdown episode, local trough date when the minimum return was experienced within the drawdown episode, catch-up date when the prior high-water mark was scaled again and wipe-out date which essentially states the length of the prior period cumulative return that was extinguished by the drawdown return.

Also, a chart on the drawdown episodes chronologically organized (drawdown in red on left y-axis; cumulative return in green on right y-axis) followed by a time-aligned time series of the latest and 3 worst drawdown episodes.

While these analyses are strictly based on formal drawdown, where a drawdown episode ends only when the trailing high-water mark is scaled, in other venues where I study extreme-episode behavior, in order to harvest more and more frequent drawdown episodes, I auto modify the high-water mark when a certain threshold of +ve return is earned following a local minima/trough; this prevents long, protracted drawdown episodes by splitting them into several punctuated drawdown episodes.

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors