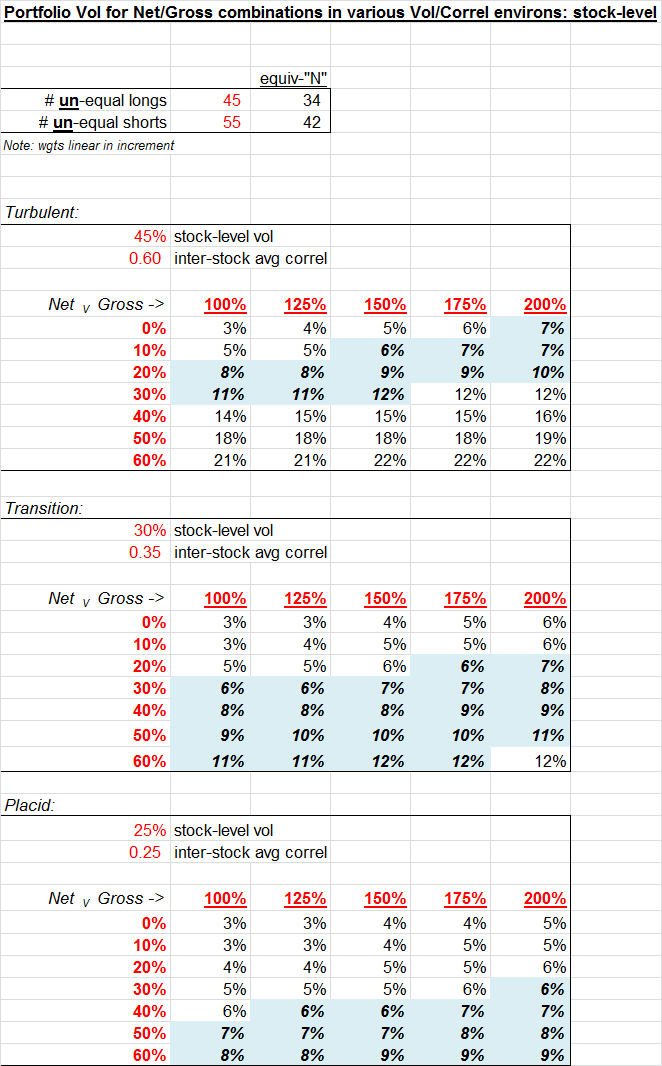

Punch line: the following broadly-illustrative guidepost solves for alternate net and gross exposure combinations that achieve a threshold level of portfolio volatility (highlighted between 6%-12%) across various volatility/correlation regimes: turbulent, transition and placid.

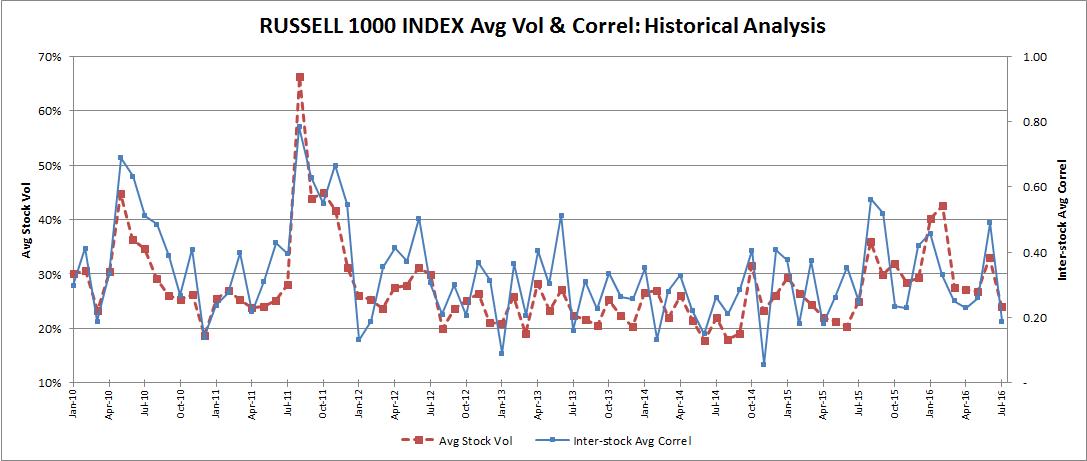

The shifting sands of volatility/correlation regime can be quite fickle and often leave portfolio volatility vulnerable to extreme swings.

As a general principal, in order to achieve a given threshold of portfolio volatility, net and gross exposure should be inversely proportional to the prevailing volatility/correlation regime.

The following broadly-illustrative guidepost solves for alternate net and gross exposure combinations that achieve a threshold level of portfolio volatility (highlighted between 6%-12%) across various volatility/correlation regimes: turbulent, transition and placid.

The portfolio parameters underlying this analysis represent a hypothetical well-diversified portfolio, both across economic sectors and number of positions. Specifically, I used 45 longs and 55 shorts, linearly declining in stock weight, to proximate a realistic portfolio construct.

In order to define volatility/correlation regime, I used the Russell 1000 stock universe to compute monthly average stock volatility and correlation over the recent past (1/1/2010 to 7/31/2016; monthly granularity; charted below) which includes volatility/correlation regimes of all flavor. Specifically, I used massaged values of the volatility/correlation %-tile distribution gleaned from the above data and used the following thresholds to define volatility/correlation regime:

- turbulent, macro-driven regime: 95%-tile

- transition regime: 50-75%-tile

- placid, stock-picker regime: 25%-tile

Finally, as a caveat, the portfolio volatility surface will be non-trivially higher for concentrated portfolios, those with fewer names, sector-focused portfolios and/or those with thematic industry and stylistic biases.

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors