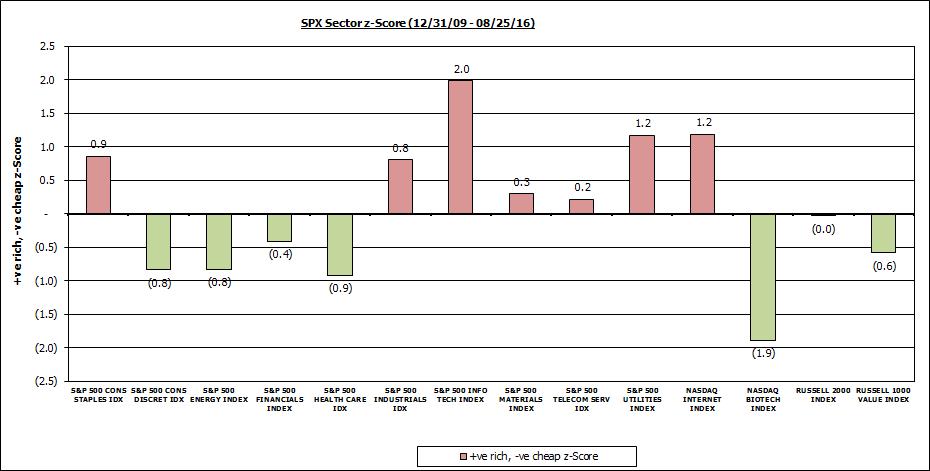

Punch line: currently the following S&P 500 sectors are flagged on a relative-value basis:

- mildly rich: info tech

- biased rich: utilities (low-confidence fit), internet index (QNET)

- mildly cheap: biotech index (NBI; low-confidence fit)

The following high-level, trend-adjusted regression analysis may help serve as a rich-cheap relative-value barometer for the S&P500 sector space (along with a few other focused indices), relative to the broad market.

Currently, as reflected in the chart below and in more detail in the attached pdf, the following sectors are flagged on a relative-value basis:

- mildly rich: info tech

- biased rich: utilities (low-confidence fit), internet index (QNET)

- FV zone, richer end: consumer staples, industrials

- FV zone, cheaper end: consumer discretionary, energy (low-confidence fit), healthcare, Russell 1000 value

- mildly cheap: biotech index (NBI; low-confidence fit)

By regressing each S&P 500 sector, adjusted for trend drift, on the S&P 500 index one can solve for the current richness/cheapness of the sector, relative to the market, expressed as a z-score. Also shown are:

- min/median/max z-score thresholds over regression window to provide contextual reference

- goodness-of-fit measures to ascertain confidence in the relationship

- graphical time series of each sector regression-based z-score

Caveats:

- high-level rudimentary in-sample regression analysis susceptible to misspecification, alternate drivers and environmentally-pertinent dynamics

- these can be very noisy relationships and risk highlighting false signals, using different time horizons can produce vastly different signals and this specification doesn’t purport causation

- sector regressions with low return correlation, high standard error, low t-stats indicate noisy, low-confidence relationships

- fundamental rationality often takes a back seat to technicals, sentiment and fund flows i.e., relationships can stay at outlier states for extended time periods (thereby tending to FV as time elapses and regression betas and/or regimes change)

By design, this is a 35k’ broad-brush assessment to help telegraph potential extended sector behavior, which may help serve as a platform for further detailed investigative work.

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors