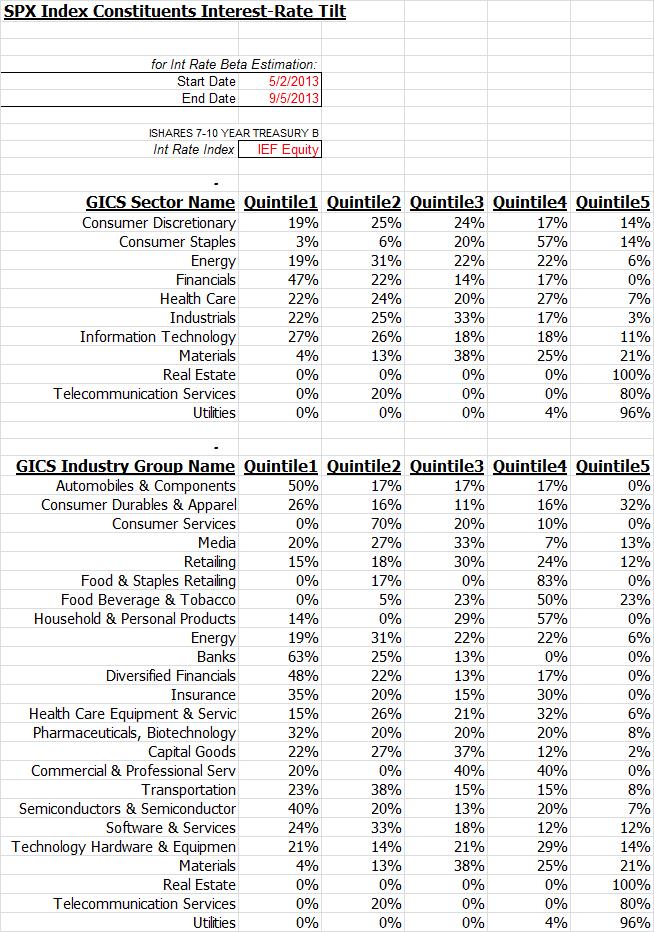

Punch line: stating the intuitively obvious: telecom services, utilities, real estate and consumer staples underperform and financials (post GFC) outperform during higher and steeper rate environments. The tables below illustrate this dynamic.

Stating the intuitively obvious, high dividend yield stocks in the US are typically telecom services, utilities, real estate and consumer staples and stand to underperform if the rate-structure evolves higher given their long-duration bond-proxy profile. On the other hand financials, which can often sport moderately healthy dividend yields, are buttressed by wider NIMs (hence earnings and earnings growth) in higher and steeper rate environments, which supersede the higher discount rate pressure. Amalgamating the two may prompt one to focus on the interest-rate beta of stocks as an empirical manifestation of the competing cross currents.

Interest-rate betas of equities tend to be fraught with noise and imprecision and hence focusing on punctuated environmentally-pertinent episodes where rate pressure was a primary factor becomes essential. This generally points to the “taper” tantrum chapter as a recent scenario with similar rate dynamics. The tables below, notwithstanding the potential for false +/-ves and signals that generally hew to intuition, partitions interest-rate beta quintiles using the universe of S&P500 stocks and shows the % of stocks, by GICS sector and industry group, that reside in the various quintiles buckets (quintile1/quintile5 least/most vulnerable to higher rates). To the extent there is an intersection of L/S watch-list stocks and sector/industry-groups in the lower/higher quintiles, that may represent an incremental data point in the information mosaic to help temper any implicit portfolio rate skew.

As a broad overarching principal, in the ST, index hedges, including targeted smart beta factor hedges, can help with risk mitigation and serve as an exposure and position-management tool. MT to LT, one gets paid to generate alpha and to that end attempting to dampen uncomfortable factor tilts in an E(alpha) +ve manner, via attractive stock candidates, is congruent with the underlying expectation-gap/variant-view philosophy of a fundamental bottom-up fund.

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors