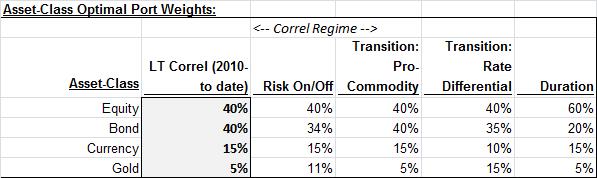

Punch line: the following analysis illustrates the macro asset-class optimal portfolio allocation sensitivity to correlation regimes. Aside from minor variations across most correlation regimes studied, the biggest takeaway is the dramatic reordering in optimal portfolio allocation under the “Duration” correlation regime, where equities and bonds are +vely correlated trading as long-duration assets, causing equity allocation to push toward the traditional 60% weight.

Dovetailing on the prior “Macro asset-class correlation regime evolution,” the following analysis illustrates the macro asset-class optimal portfolio allocation sensitivity to correlation regimes.

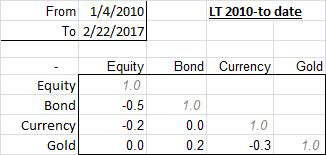

To set the stage, I compute the optimal portfolio allocation using the below correlation matrix realized over the entire horizon (Jan 1, 2010 to date; post GFC drawdown and aftermath).

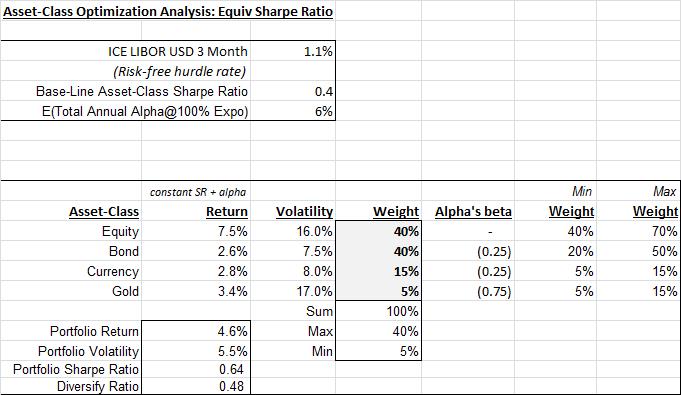

One of the many weaknesses of traditional historical mean-variance solutions is the use of historical returns which can severely handicap the analysis (more on this below**). In order to address this and provide a forward-looking perspective I introduce the following innovations:

- ex-ante unbiased risk-adjusted return expectation: constant baseline Sharpe ratio across strategies of 0.4 (broadly consistent with Ibbotson’s ultra LT risk premium)

- incremental alpha component:

- expected total annual alpha, fully invested, of 6%

- alpha’s beta scales base alpha of 6% by a beta factor which is a qualitative adjustment to reflect propensity, past and future expectation, to generate incremental value added

Invoking the user-modified mean-variance optimization framework, subject to min/max participation constraints, yields the following optimal allocation (grey highlighted box):

The optimal allocation largely pushes to the boundary participation constraints with the lower-correlation assets emphasized.

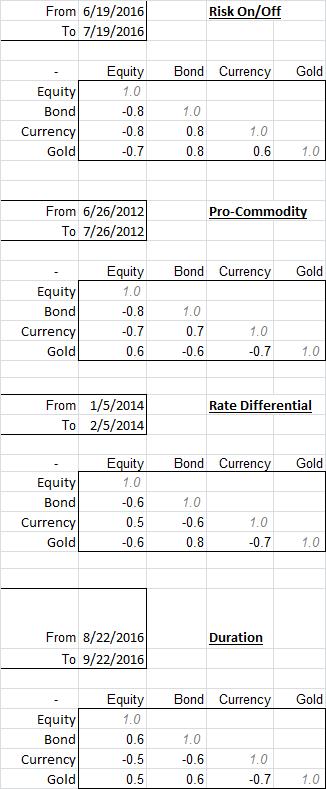

In order to illustrate the optimal allocation sensitivity to correlation regimes, I used the boundary correlation regimes from the above referenced “Macro asset-class correlation regime evolution” analysis. These are shown below:

Throwing these correlation matrices in the user-modified optimization blender yields the following optimal portfolio allocations:

Aside from minor variations across most correlation regimes studied, the biggest takeaway is the dramatic reordering in optimal portfolio allocation under the “Duration” correlation regime, where equities and bonds are +vely correlated trading as long-duration assets, causing equity allocation to push toward the traditional 60% weight.

**One of the soft underbellies of traditional mean-variance optimization solutions is the use of historical returns which tends to severely handicap the analysis (historical return may have no bearing on future return expectation; indeed, one may be long/short a historically under/out performing asset which might make optimization results stand on their head relative to future expectations). An unbiased innovation to address this is to rely on arbitrage logic that ex-ante all assets have the same expected risk-adjusted return (else the market would move into higher risk-adjusted return investments and away from lower risk-adjusted return investments so that in equilibrium all had equivalent risk-adjusted returns). Clearly, this proposition is more defensible over the theoretical long term; hence, the incremental alpha and alpha’s beta value-added terms to subjectively qualify returns.

Please note the following, amongst other, caveats, qualifications and risk-factors:

- optimization results are horribly unstable and one may arrive at vastly different solutions by varying time horizons and covariance matrices; additionally, they suffer from the “egg-crate” problem where slightly sub-optimal solutions may have more intuitively-appealing results

- this exercise is fraught with non-trivial noise and many moving parts and dimensions. Any quantitative analysis can at best serve as a starting-point suggestion designed to be qualitatively and dynamically modified, and at worst is dangerous science.

- this guidepost, along with other related analyses, may help triangulate towards an efficient allocation solution

- any such “rules” are designed to be broken and dynamically modified based on the evolving, situation-specific market environment

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors