Punch line: over the past year the Stoxx-Euro relationship on average appears quite random. However, this aggregated data belies the forceful regime behavior (traditional FX: SXXE +ve/-ve while Euro -ve/+ve vs. pro-growth: SXXE and Euro +ve/-ve in tandem) that has frequently prevailed beneath an overall ambivalent hood.

Given the flux in the Stoxx (SXXE)-Euro relationship I studied its evolving behavior over the recent past partitioned by correlation regime: traditional FX regime (SXXE +ve/-ve while Euro -ve/+ve) where trade-competitiveness/currency-translation dynamic holds sway vs. pro-growth regime (SXXE and Euro +ve/-ve in tandem) where growth and growth-differentials color both concurrently.

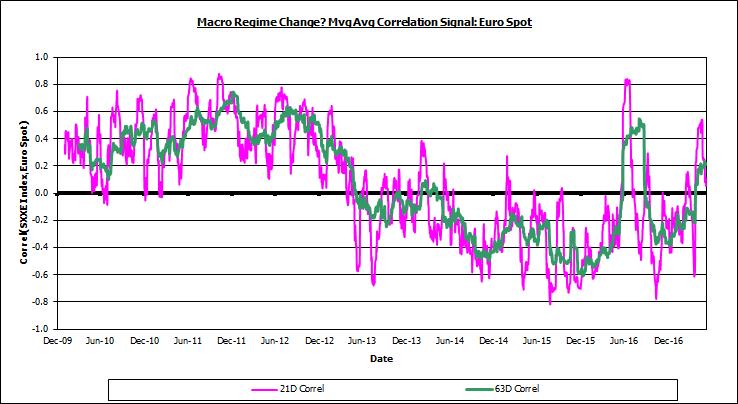

The time-series chart below frames the analysis by tracing the Stoxx-Euro moving-average correlation from Jan 1, 2010 to date. As the chart attests, there have been forceful and protracted instances of traditional FX as well as pro-growth behaviour. Coming out of the GFC correlation was +ve highlighting the pro-growth regime; post Draghi’s “whatever-it-takes” reflation correlation was –ve underscoring the traditional FX regime; and lately, once again, there have been data-facilitated pro-growth regime bursts. Interestingly, traditionally flight-to-quality, including existential Brexit-like episodes, saw both the Stoxx-Euro move in concert, whereas post Draghi reflation, where the Euro became a carry-trade funding currency, safe-haven flows often saw Stoxx-Euro move inversely as carry trades were unwound.

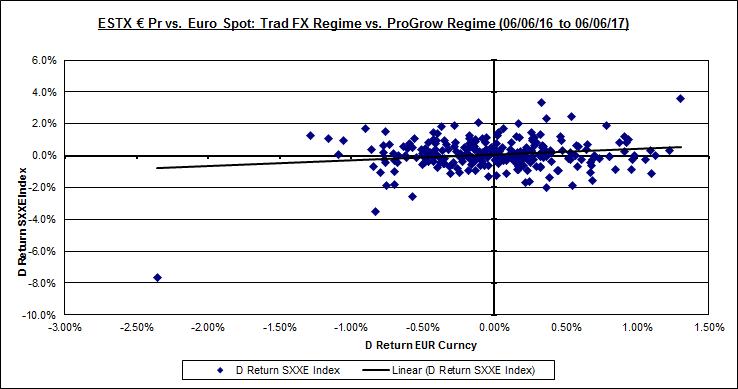

Telescoping to the past year, the scatter-plot below shows that the STOXX-EURO co-movement dynamic has on average been fairly random.

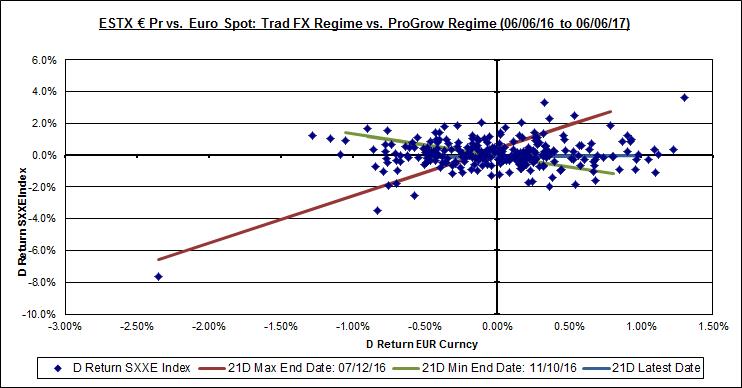

However, this aggregated data belies the more forceful regime behavior that has frequently prevailed, in the ST, over the year past. The chart below superimposes the most forceful instances of ST regime behavior via their piece-wise regression lines. The brown line reflects the pro-growth regime prevalent during the 21d ending 07/12/16 (correlation +0.8) and the green line depicts the traditional-FX regime prevalent during the 21d ending 11/10/16 (correlation -0.8).

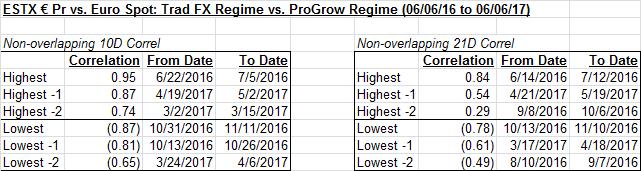

As illustrated in the table below, using 10d and 21d non-overlapping windows over the past year, there have been multiple instances of forceful Stoxx-Euro behavior in either direction.

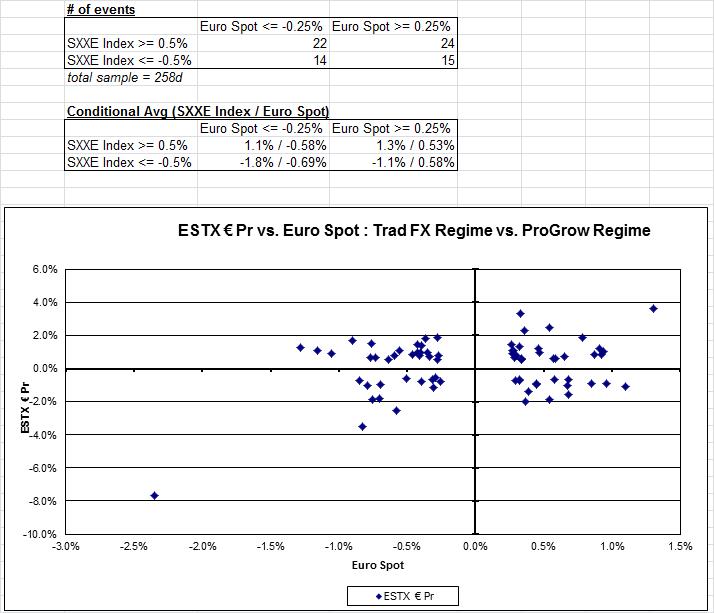

This message, of forceful regime episodes beneath an overall ambivalent hood, is further reinforced using “significant” Stoxx-Euro days: Stoxx >= +/- 50bp and Euro >= +/- 25bp (both 0.5-sigma thresholds). The table and chart below illustrate that all four quadrants are well populated.

More granular detail is provided in SXXE vs EUR Trad FX vs Pro-Grow PDF.

Regime- and “significant”-day conditional industry sensitivity:

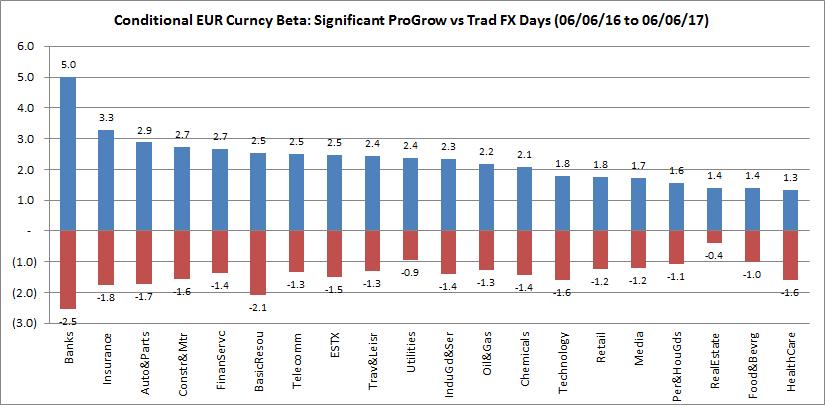

Next, I looked at the industry sensitivity, as measured by conditional beta, using the “significant”-day criteria and segmented by correlation regime. While several industries, such as banks and insurance, had forceful +ve pro-growth and –ve traditional-FX betas (differential magnitude notwithstanding) to the Euro conditional on the correlation regime, others, such as utilities and real estate had asymmetric relative betas, which highlights that industry sensitivity to the Euro, sign and magnitude (relative and absolute), was contingent on the underlying equity-currency correlation regime. This is reflected in the chart below:

(Note: the June 24, 2016 Brexit data-point was not “winorized” from the data-set and skews +ve pro-growth betas, particularly for banks, upwards.)

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors