Punch line: over the mid-term past, dollar-rally episodes have virtually always been associated with EM under-performance. The message telegraphed by EM industry excess returns, over these episodes, largely hues to intuition with the magnitude of the industry response colored by cyclicality.

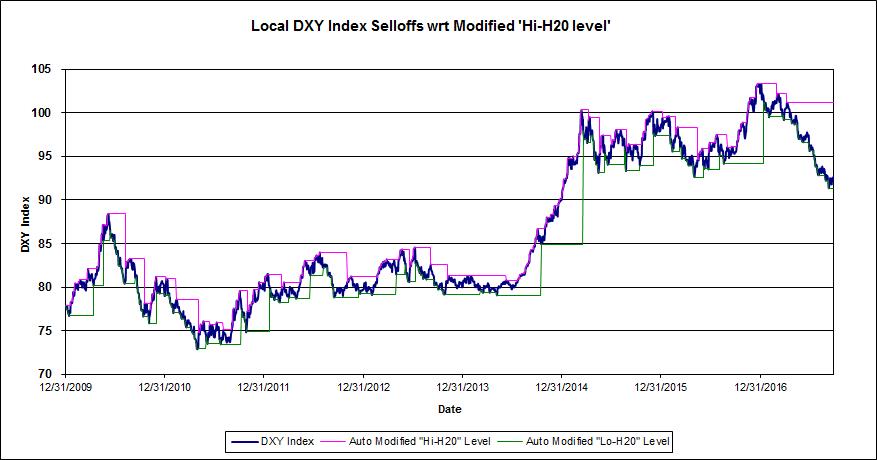

Over the last year the dollar has largely marched to the beat of the fiscal-stimulus and monetary-tightening drummer: surging on reflation hope and rate-hike anticipation and receding on unrequited expectation. Lately, with tax cuts on the table and the Fed potentially in play, the dollar appears to have found a tenuous local floor. While the hitherto weaker dollar has been a boon to EM out-performance, as capital flowed to EM shores chasing higher yields/returns, a stronger dollar might present a capital-flight headwind to EM relative performance, à la Q4, 2016. To investigate, I looked at relative EM vs. DM performance over extreme dollar (DXY) rally/selloff episodes over the mid-term past (Jan 1, 2010 to date; post GFC draw-down and aftermath). I selected the top 15 DXY rally/selloff episodes, subject to a modified high-water mark, harvested from the chart below.

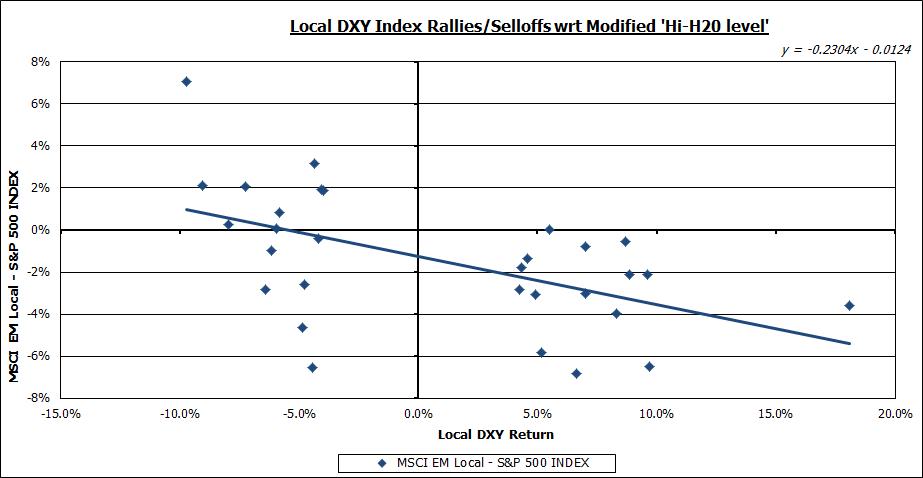

In order to test the inverse dollar to EM/DM relative-performance hypothesis, I looked at the MSCI EM to S&P500 excess return over these extreme DXY rally/selloff episodes. This is reflected in the chart below:

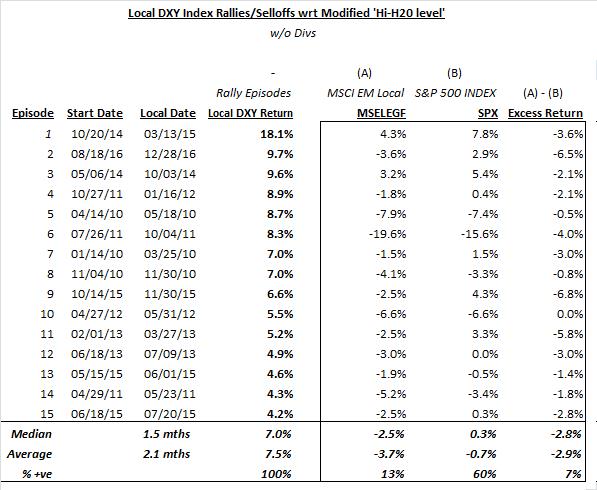

While extreme DXY selloffs don’t unambiguously foretell EM out-performance, extreme DXY rallies have virtually always been associated with EM under-performance, over this recent sample period. This is depicted more precisely in the table below:

Finally, the pdf below displays an industry-level drill-down to highlight EM industry performance, vs. the broad EM index, over these dollar-rally episodes. The message largely hues to intuition with the magnitude of the industry excess return colored by cyclicality.

DXY rally episodes EM industry response

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors