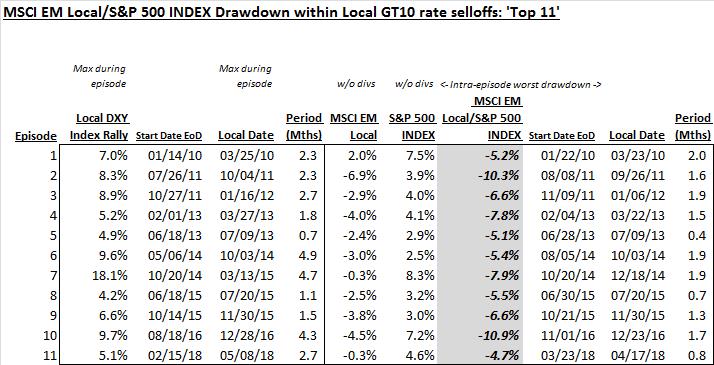

Punch line: over the mid-term past, dollar-rally episodes have virtually always been associated with EM equity under-performance. Drilling down to EM sector performance, healthcare and consumer staples have fairly consistently out-performed, and real estate has quite regularly under-performed, the broad EM index over extreme dollar-rally episodes.

Following up on the Dollar and EM post from last fall, the below analysis provides an update for the latest dollar-rally episode and presents a more granular innovation to better trace EM vs. DM equity (MSCI EM local vs S&P 500) performance dynamics set against a rising-dollar (DXY) canvas.

To paraphrase, while extreme DXY selloffs don’t unambiguously foretell EM out-performance, extreme DXY rallies have virtually always been associated with EM under-performance, over this recent sample period.

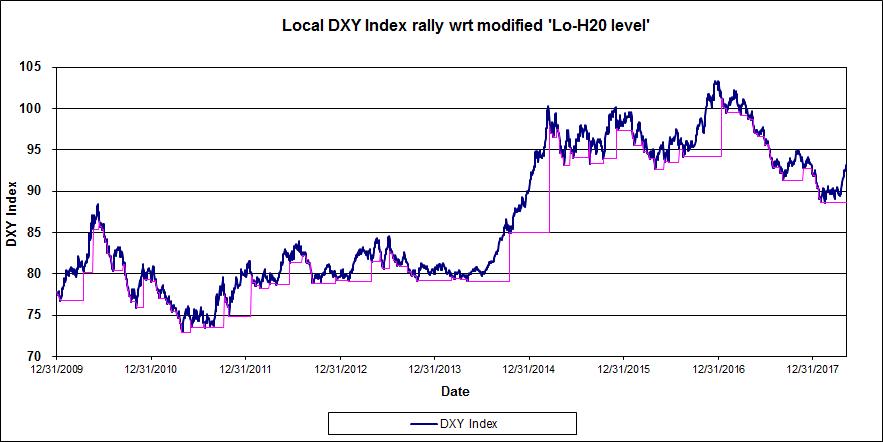

As before, I harvested significant DXY rally episodes, subject to a modified low-water mark, from the chart below (Jan 1, 2010 to date; post GFC draw-down and aftermath):

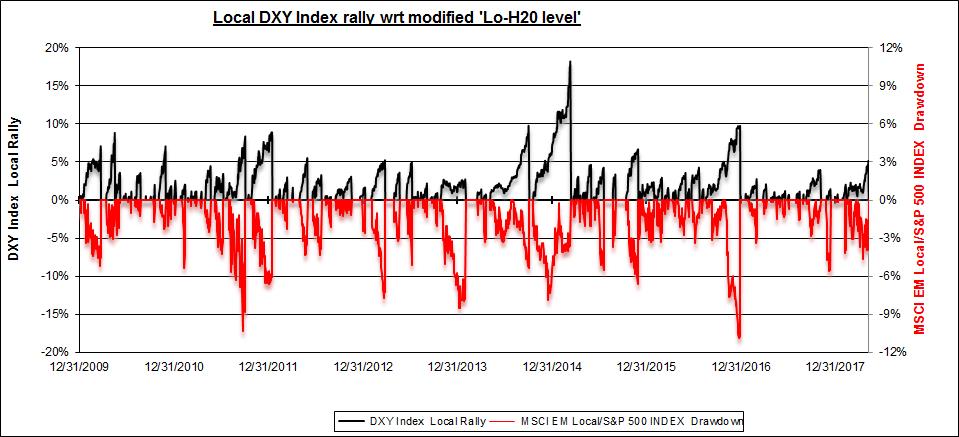

Since, more often than not, the max EM/DM under-performance does not occur concurrently with the local DXY rally episode, I combed through each DXY rally episodes to tease out the max intra-episode EM/DM relative-return drawdown (scenario-generation mechanics described below**). This is visually depicted in the following chart (left y-axis: DXY in black; right y-axis: EM/DM relative return in red):

Further, I only selected extreme DXY-contingent episodes where the EM/DM relative-return drawdown was <= -4.5% and DXY rally was >= 4.0%; this yielded 11 extreme joint episodes, shown below:

Finally, the below pdf enumerates the intra-period MSCI EM sector response, ranked best to worst, within extreme DXY-rally episodes. As the scenarios are quite disparate it may be more meaningful to focus on environmentally-pertinent episodes.

Episodic EM sector perf vs. DXY

**To illustrate the episode-generation process consider the following e.g.: latest local DXY rally episode (02/15/18 – 05/08/18): 5.1%; max intra-episode EM/DM relative-return drawdown (03/23/18 – 04/17/18): -4.7%. Since EM/DM relative-return <= -4.5% and DXY rally >= 4.0%, this represents a joint extreme-episode scenario.

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors