Punch line: Q2, 2018 S&P 500 sector returns were mostly higher led by out-sized gains in energy. Intra-sector stock-returns sported relatively tighter groupings in several macro-tinged sectors. These risk-return outcomes are reflected in the charts and tables below.

The following is an update of the quarterly sector-level dispersion analysis which reveals largely ascendant sector returns, led by energy, and macro-tinged concordant outcomes in several sectors:

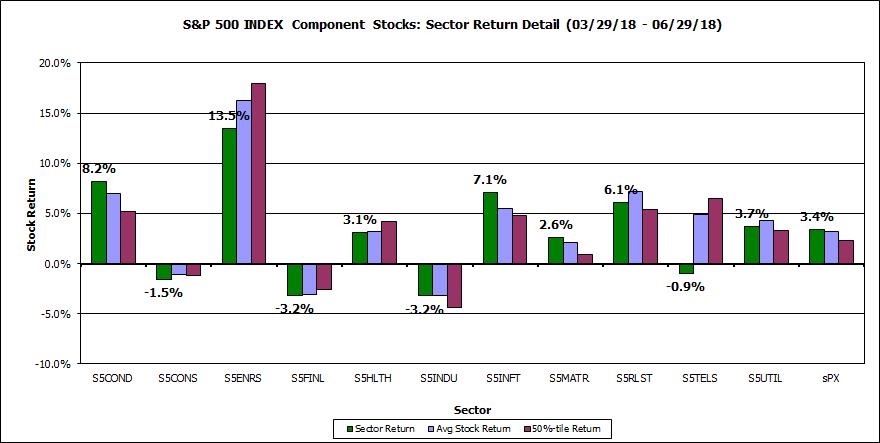

This first chart notes the sector (cap-weighted) return (green bars), average (equally-weighted) return (blue bars) and median stock return (burgundy bars) for the various sector of the S&P 500 over the Q2, 2018 horizon (with dividends, latest constituents). Sector returns, save financials, industrials, consumer staples and telecom services, were positive led by outsized gains in energy. For most sectors, save consumer discretionary, info tech and materials, cap-weighted returns fared worse than equally-weighted returns reflecting large-cap underperformance in the S&P 500 sector space.

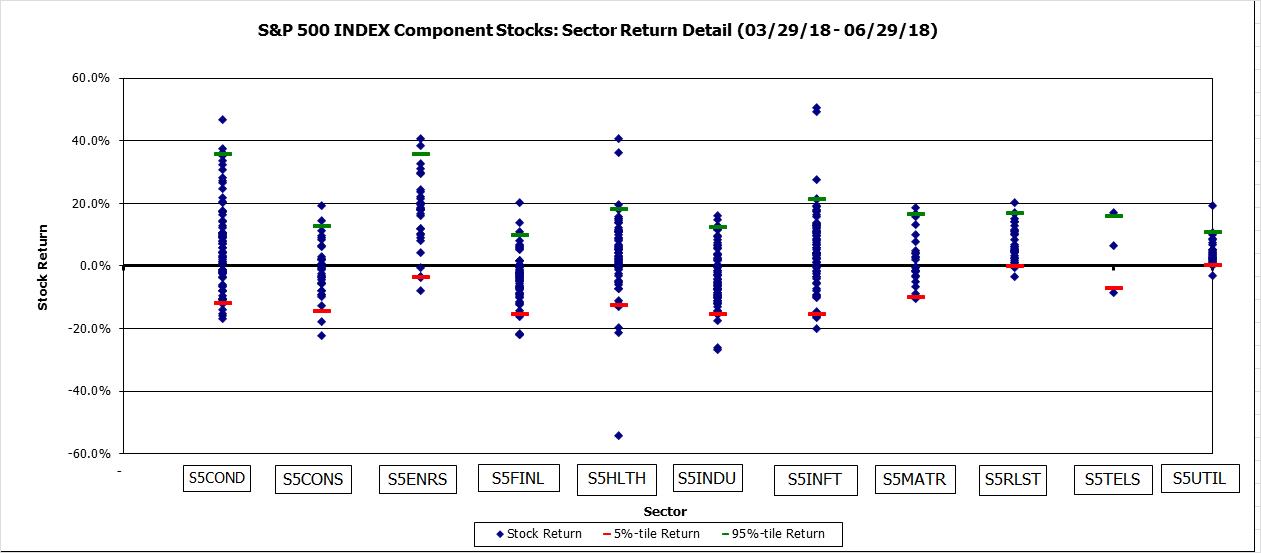

Next, a scatter plot of stock returns by sector, along with 5%- & 95%-tile markers. Intra-sector stock-returns, relative to their volatility, were tinged by common macro influences, sporting relatively tighter groupings, in several sectors including consumer staples, energy, financials, industrials, materials, real estate and utilities. This is visually apparent in the chart below and more precisely in the table that follows.

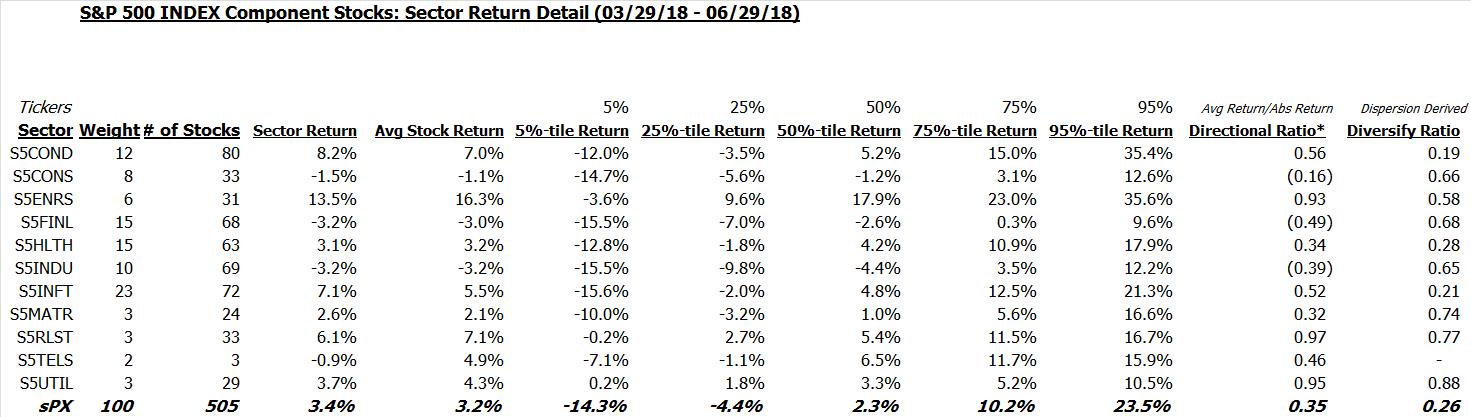

This is also shown in tabular form along with the %-tile sector return distribution. Also shown is the directional ratio (avg net return to avg gross return) and dispersion-based diversification ratio (index vol/component vol), which points to less differentiated outcomes in several sectors.

Finally, a listing of stock returns, by sector, ranked in descending order of performance is shown in the pdf link below:

Stock by sector returns Q2, 2018

And, very finally, the cumulative abnormal return (“CAR”; summation of daily beta-adjusted excess return) of the S&P 500 GICS industries, over the Q2, 2018 horizon. I ran the CAR for each S&P 500 industry, sorted them in order of outperformance, and then charted the top 10/bottom 10 CAR industries in the below pdfs:

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors