Punch line: the abnormally low term premium (-16bp; “pTP”) has conspired to depress the 2/10 spread (35bp). Using a simplistic heuristic, if the term premium were to revert to 10bp that would be consistent with a 2/10 spread of 83bp, all other parameters held constant.

The chatterati have once again homed in on the latest dive lower in the UST 2/10 spread with some going as far as to suggest it telegraphs an impending recession. (Generalizing, academic literature looks at the average monthly 10y to 3m UST spread inversion to potentially signal a recession 4-6 quarters out.)

While the Fed may well ultimately “murder” the expansion with its hikes, particularly in the context of a lower equilibrium funds rate and global fragility, it is instructive to note that a -ve term premium has conspired to depress the 2/10 spread relative to what the spread would be in the context of a less abnormal term premium. Please refer to “Unsophisticated term premium” for further details on my practitioner’s term-premium (“pTP” **) construct and “Global yields: correlated vs. independent impulse” for the gravitational pull lower from the fragile overseas yield impulse.

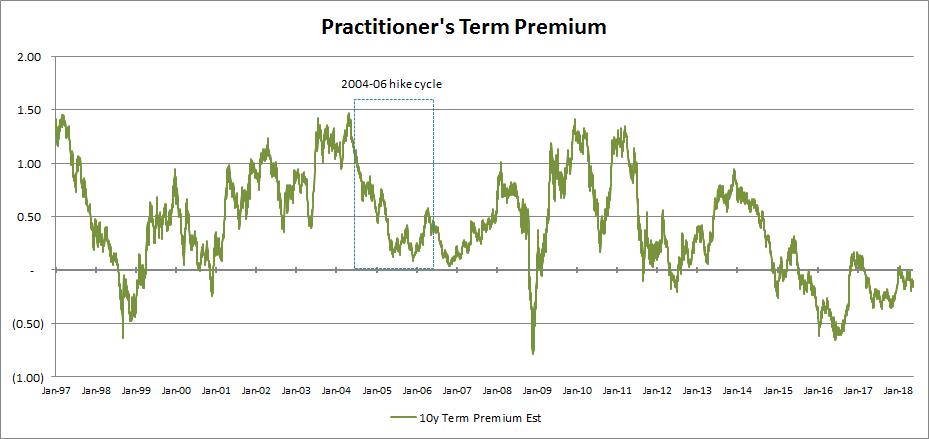

As reflected in the chart below, the term premium has been depressed and –ve recently. This stands in contrast to the substantially higher, though falling, term premium during the last Fed hike episode (boxed area in chart and summarized in table that follows).

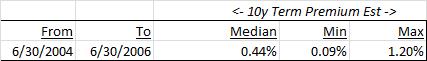

In order to crudely infer what the 2/10 spread might be under less extreme levels of the term premium, I inverted the estimation construct to infer the former for various levels of the latter, assuming all other parameters unchanged. This is quite a simplistic heuristic, as, in reality, the various parameters interact dynamically with each other based on their linked relationship, but nonetheless this provides a rough rule of thumb.

As reflected in the table below, the current 2/10 spread of 35bp, along with other parameter values, produces a term premium of -16bp (highlighted values). If the term premium were to revert to 10bp, for instance, the 2/10 spread would widen to 83bp, all other parameters held constant.

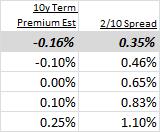

Further, the current 2/10 spread stands at the 25%-tile relative to its own daily history over the last 20+ years. If one adjusts the 10-year yield by the 10-year term premium (effectively the 10-year average expected short rate), this “10y term-premium-adjusted 2/10 spread” would reside at the 35%-tile over the same horizon. These dynamics are reflected in the chart below:

** Note: unsophisticated term premium (“uTP”) re-branded as practitioner’s term premium (“pTP”)

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors