Punch line: given the potential for systemic fragility in the wake of the Italian elections, Teflon-market notwithstanding, I looked at the most onerous episodes of a cross asset-class, Europe-driven contagion barometer, which spilt over into the US, and the resultant macro asset-class response.

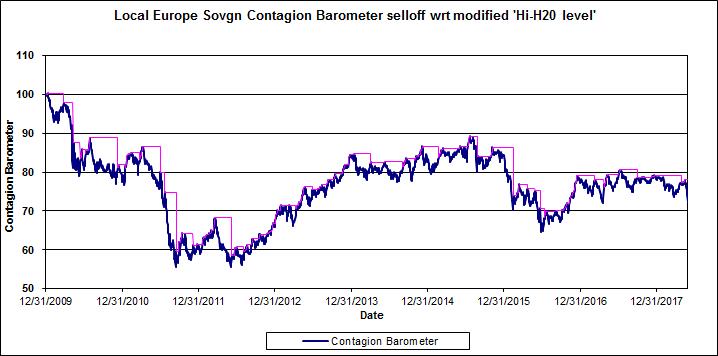

Given the potential for systemic fragility in the wake of the Italian elections, sang-froid markets notwithstanding, I resurrected a cross asset-class, Europe-driven contagion barometer (Jan 1, 2010 to date; post GFC draw-down and aftermath; subject to a modified high-water mark) that also triggered contagion across the Atlantic. The systemic-contagion barometer, depicted in the chart below, includes:

- equities (bank: SX7E)

- volatility (V2X)

- rates (5y Bund)

- credit (Europe financials CDS)

- currency (JPY)

- commodity (gold)

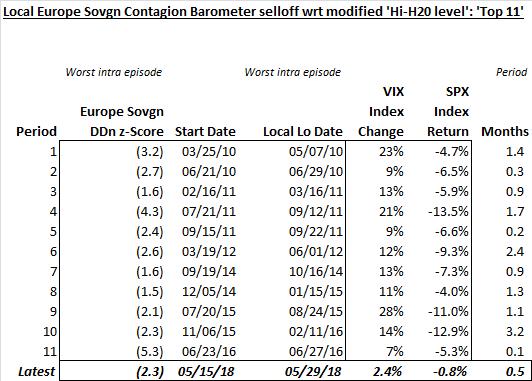

To reflect contagion transmission into the US, and restrict it to periods of extreme stress, I only selected episodes conditional on S&P 500 returning <= -3% and VIX absolute level rising >= 5%; this yielded 11 systemic-stress episodes which are shown in the table below. The systemic-stress episodes are presented as volatility-calibrated z-score units.

Finally, shown in the pdf below are the return/change statistics for a variety of macro asset-classes (indices that comprise the systemic-contagion barometer are highlighted in grey) along with median and hit-rate metrics. In the event the various simmering crises escalate into a more insidious systemic downdraft, despite the current market nonchalance, this may provide a handy macro-response guide to past Europe-driven contagion episodes.

Europe systemic contagion barometer Macro Assets

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors