Punch line: the risk of insolvency has the potential to significantly disrupt projected cash-flow streams and going-concern value and, commensurately, the modeling and valuation of risky ventures. This final high-growth VC illustration concludes the trilogy of simulation-based risky-asset pricing frameworks.

Investing in risky projects where projected cash-flows and going-concern value are subject to significant uncertainty involves modeling and pricing for the inherent risk of bankruptcy. The following stylized high-growth VC illustration provides a rudimentary simulation-based valuation framework where insolvency risk has the potential to significantly disrupt the “base-case” projected cash-flow stream and, hence, venture valuation.

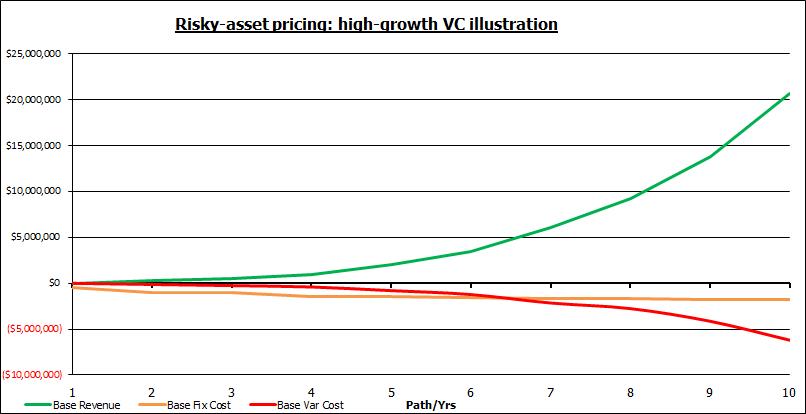

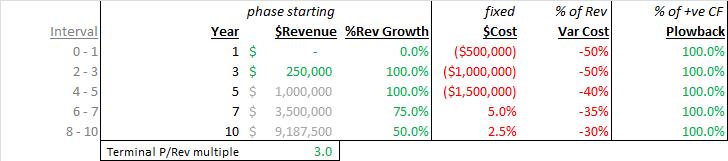

To set the stage, assume the following “base-case” multi-phase revenue-cost curve spread over a 10-year venture horizon along with a terminal-value multiple to reflect exit valuation. Revenue, post an initial seed value, follows a high-growth curve and costs are split into fixed costs (lease, rent, equipment, fees, permits, insurance etc.) and variable costs (100% – margin %). Negative cash-flow implies capital infusion and positive cash-flow is subject to plow-back reinvestment. These assumptions are reflected in the chart and table below:

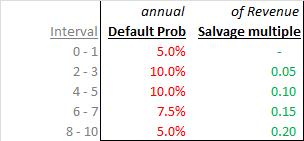

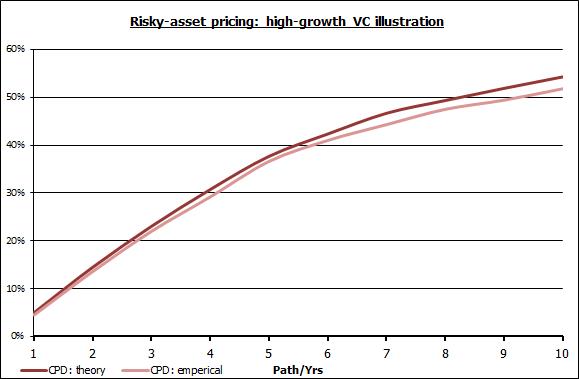

Next, in order to introduce the potential for bankruptcy to disrupt projected operations, consider the following “hump-backed” default-probability curve along with salvage-value/recovery multiples. These are reflected in the table and chart (cumulative default probability) below:

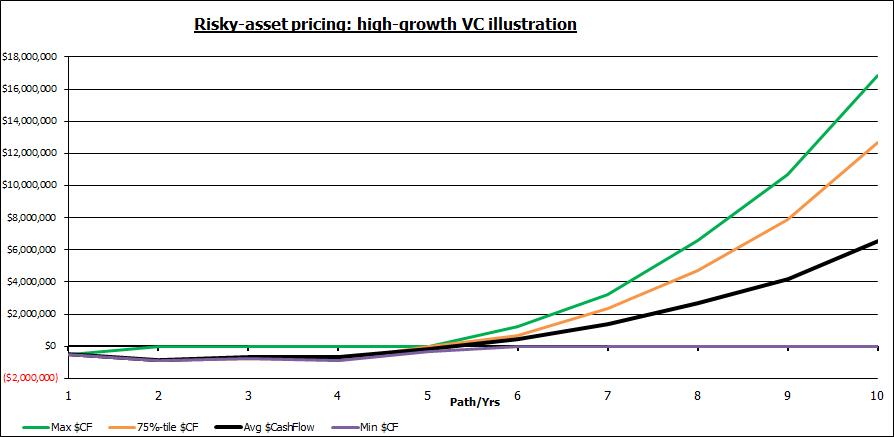

Next, in order to reflect the cash-flow impact of potential insolvency, populate a 1000×10 matrix (1000 paths of 10 annums each) with random draws from a standardized normal distribution and use that to trigger bankruptcy, or not, per the specifications above and accordingly simulate annual cash-flows along each path, accounting for the path dependency of prior outcomes. (For e.g. if a random draw of -1.9 occurs in year 8 then, since it’s worse than the z-value threshold level associated with the 5% default-probability assumption, the firm goes belly-up voiding future cash-flows (save salvage-value). These cash-flow dynamics are illustrated in the chart below (bold black line is the expected-value path):

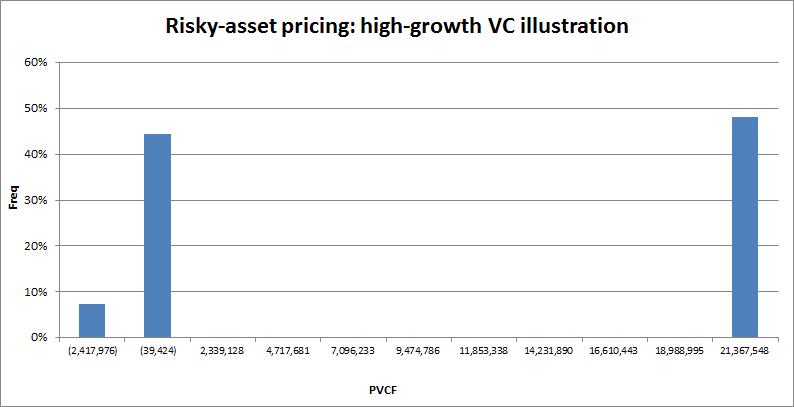

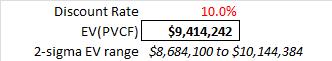

Next, assuming a healthy discount rate** (UST 10y + incremental risk premium/OAS; 10% all-in this illustration), compute the present value of the cash-flows along each path. This is reflected in the frequency chart below with the long-left tail highlighting the cash-flow impact from bankruptcy:

Aggregating, the average of the present value of the path cash-flow streams represents the potential valuation of this risky investment in a simulation-based risky world. Additionally, to illustrate the potential for sampling error, we can also compute the 95% confidence range around the expected valuation (95% of the time the true expected value, population mean, lies between a 2-sigma range).

Using this simulation-based valuation along with the standard no-default, base-case cash-flow stream, post plow-back, yields conventional IRR:

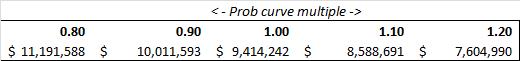

Finally, in the spirit of sensitivity analysis, the following table represents the NPV sensitivity to multiples of the base-line default-probability curve:

In summation, the above analysis provides a rudimentary framework for risk-return decision-making under uncertainty and underscores the importance of probabilistic valuation given the potential for insolvency to introduce significant dispersion in projected cash-flow streams and going-concern value; potentially serving as an additional pricing tool in the stable of valuation metrics.

** discount rate: theoretically, default-adjusted cash-flows should be discounted at the term risk-free rate (similar to option pricing) as they’ve been defanged of risk. However, additional risks (illiquidity, constrained demand, exit hurdle etc.) warrant an incremental risk premium/OAS (option-adjusted spread) to compensate for the enhanced set of risks embraced.

Note: calculations Risk Advisors

Proprietary and confidential to Risk Advisors