Punch line: the current UST10y yield of 3.50%, combined with a VIX-adjusted risk premium of 1.97% (VIX@17), would suggest the stock market (S&P 500) valuation needs to compress by 7% to get to equilibrium fair value.

The oft-cited Fed model, popularized by Greenspan, compares the earnings yield of the stock market with bond yields in order to broadly gauge equilibrium cross-market valuation. It has many shortcomings and is overly simplistic, yet at its heart is intuitively appealing, risk-premium issues aside, by virtue of its implicit real-world yardstick of comparing competing yields on alternative market investments.

Further, it is internally consistent with manipulating the standard dividend discounting model, making a few heroic assumptions. The results of which posit that the stock market equilibrium P/E ratio should be inversely related to the risk-adjusted discount rate (UST10y yield + risk premium).

In order to finesse an uncertainty-contingent risk premium, static risk premium is dynamically adjusted for expected volatility (VIX), calibrated off baseline levels, via the empirical S&P 500 return to VIX-change relationship and stock-yield duration relationship (more on this below).

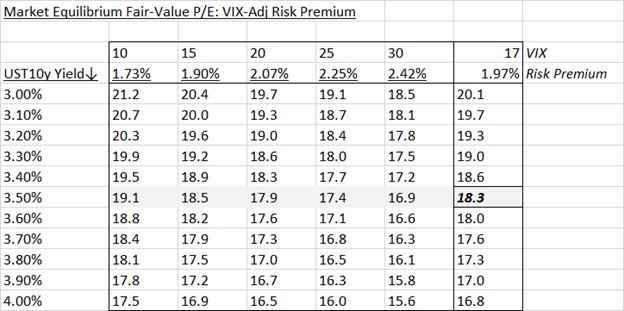

The equilibrium fair-value P/E ratio is shown in the table below for various UST10y yield and risk-premium assumptions (using interpolated 1y forward E; as reported):

For instance, the current UST10y yield of 3.50%, combined with a risk premium of 1.97% (VIX@17), would suggest an equilibrium P/E of 18.3.

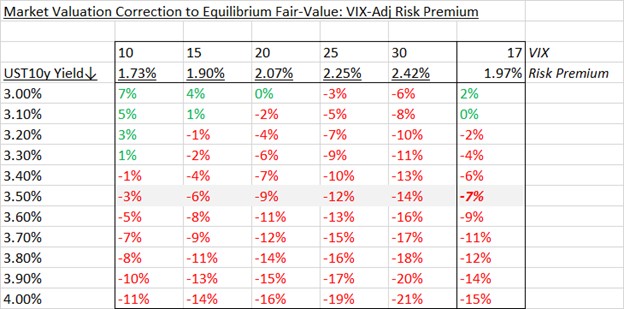

Given the current stock market P/E of 19.7 (S&P 500; interpolated 1y forward E; as reported), we can solve for the market valuation correction required to get to fair value (via change in P, E or a combination of both). This is reflected in the table below:

Using the aforementioned 3.50% UST10y yield and 1.97% risk premium, would suggest the market valuation needs to compress by 7% to get to equilibrium fair value.

Related, the implied risk premium that is consistent with the current market P/E of 19.7 (earnings yield 5.07%) and UST10y of 3.50%, is 1.57%, which can further serve as a rich-cheap barometer.

Finally, the equilibrium P/E, at various UST10y yield and risk-premium combinations, also serves as the theoretical stock market duration (% change in price for a 1% change in discount rate). Thus, a UST10y yield of 3.50%, combined with a risk premium of 1.97%, would also imply a stock market duration of 18.3; a 10bp increase in rates would suggest a 1.83% fall in the stock market.

In summation, despite the framework used, simplistic or sophisticated, valuation is neither a sufficient nor a necessary condition for market correction; at best it’s a supportive indicator. And markets can stay misvalued for a lot longer than a contrarian can stay solvent.

Note: calculations Risk Advisors

Proprietary and confidential to Risk Advisors