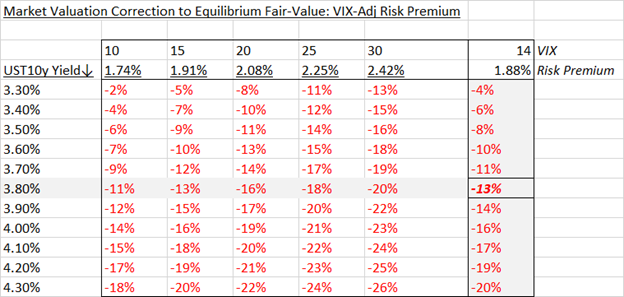

Punch line: the current UST10y yield of 3.80%, combined with a VIX-adjusted risk premium of 1.88% (VIX@14), would suggest the stock market (S&P 500) valuation needs to compress by 13% to get to equilibrium fair value.

Given the current stock-market insouciance, against the backdrop of choppy macro crosscurrents and summer seasonality, I updated my rudimentary stock-market valuation framework, for current market parameters. The table below shows the market valuation correction required to get to equilibrium fair value (via change in P, E or a combination of both), for various UST10y yield and VIX-contingent risk-premium assumptions:

The current UST10y yield of 3.80%, combined with a VIX-adjusted risk premium of 1.88% (VIX@14), would suggest market valuation needs to compress by 13% to get to equilibrium fair value.

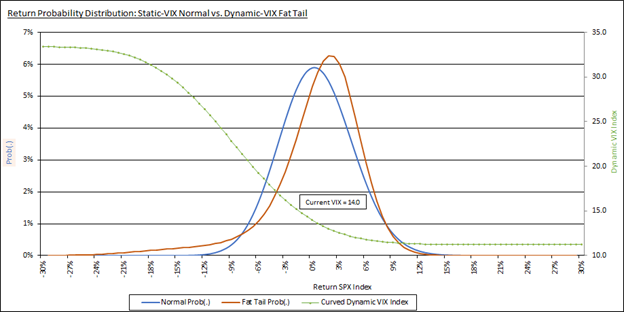

In a related vein, the following chart displays the return probability distribution, over a 1m horizon, using a static VIX (normal) vs. dynamically-adjusted VIX (fat-tail) to illustrate the likelihood of extreme left-tail events.

For instance, the likelihood of -10% or worse monthly return, is 0.4% under normality vs. 4.7% using fat-tails; for -15% or worse monthly return, normality posits no worries vs. a 2.2% chance using fat-tails.

In summation, despite the framework used, simplistic or sophisticated, valuation is neither a sufficient nor a necessary condition for market correction; at best it’s a supportive indicator. And markets can stay misvalued for a lot longer than a contrarian can stay solvent.

Note: calculations Risk Advisors

Proprietary and confidential to Risk Advisors