Punch line: over the last 6m the SPX-UST10y relationship on average appears noisily marginally +ve. However, this aggregated data belies the more forceful regime behaviour (risk-premium, on/off, much more so than duration-based) that has frequently prevailed, in the ST, within this 6m horizon. Focusing on the 3 most +ve episodic 10d correlation (risk-premium regime; SPX +ve/-ve as UST10y yield +ve/-ve) sub-horizons reveals, at the risk of false signals and coincidental correlations, that SPX industries that consistently have the strongest correlation to UST10y yield, and are thus relatively more vulnerable to yields falling and relatively more favourably disposed to its rising, include: banks, autos & components, insurance, retailing and capital goods. On the other side of the coin, SPX industries that consistently have the weakest correlation to UST10y yield, and are thus relatively less vulnerable to rates falling and less favourably disposed to its rising include: utilities, real estate, energy, telecom services and consumer services.

Given the prevailing equity-rate tension I took an updated look at the SPX-UST10y relationship & SPX industry correlation response over the most recent past in an attempt to discern any convincing regime behaviour: risk-premium (on/off) vs. duration-based regime (or growth vs. policy regime).

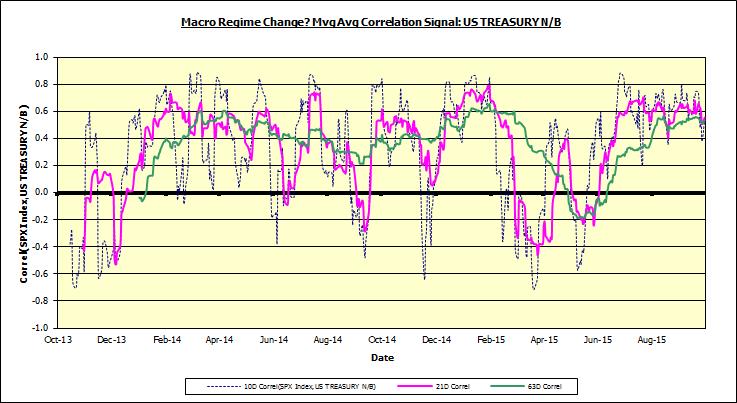

The time-series chart below frames the analysis by tracing the SPX-UST10y moving average correlation over the last 2y.

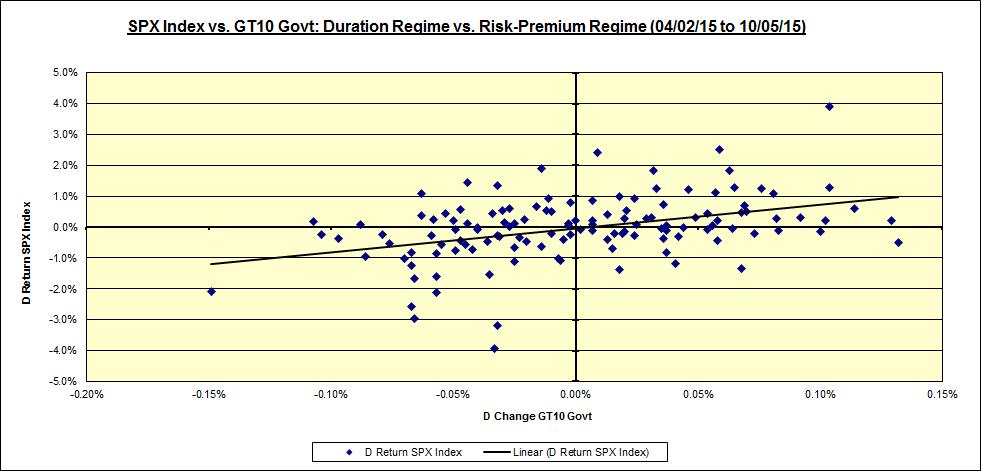

Telescoping to the most recent 6m, the scatterplot below shows that the dynamic has on average been noisily marginally +ve.

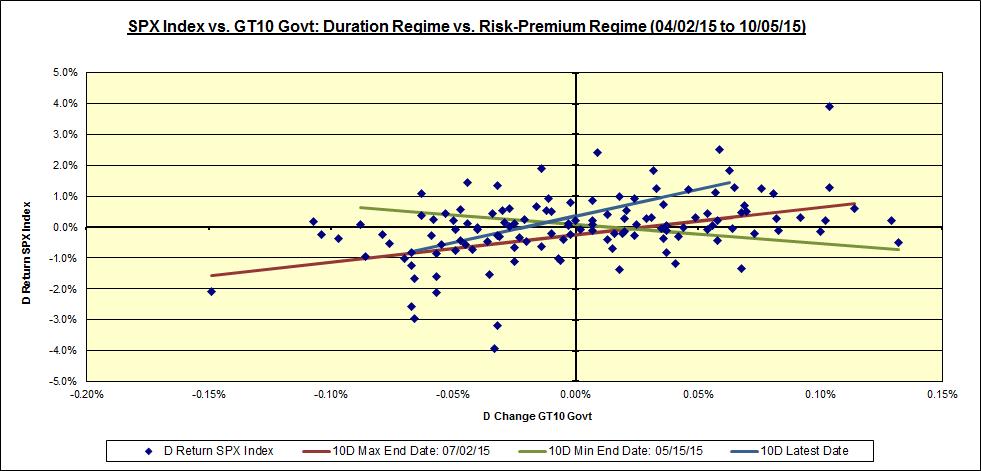

However, this aggregated data belies the more forceful regime behaviour that has frequently prevailed, in the ST, within this 6m horizon. The chart below superimposes the most forceful instances of ST regime behaviour via their piece-wise regression lines, statistical-significance notwithstanding. The brown line reflects the risk-premium regime prevalent during the 10d ending 07/02/15 (correlation +0.9) and the green line depicts the duration-based regime prevalent during the 10d ending 05/15/15 (correlation -0.6) (the blue line estimates the latest 10d behaviour ending 10/05/15).

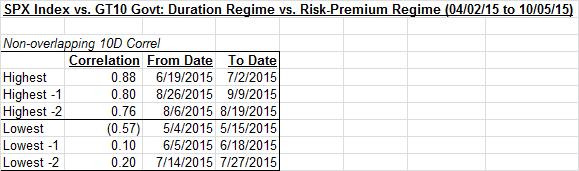

As one might expect given some of the recent manic market behaviour, over the last 6m the risk-premium regime has occurred much more forcefully than the duration-based regime. Indeed, as illustrated in the table below, using 10d non-overlapping windows over the last 6m, the 3 most +ve episodic 10d correlations (risk-premium regime) have occurred much more vigorously, and more recently, than the singular duration-based regime episode.

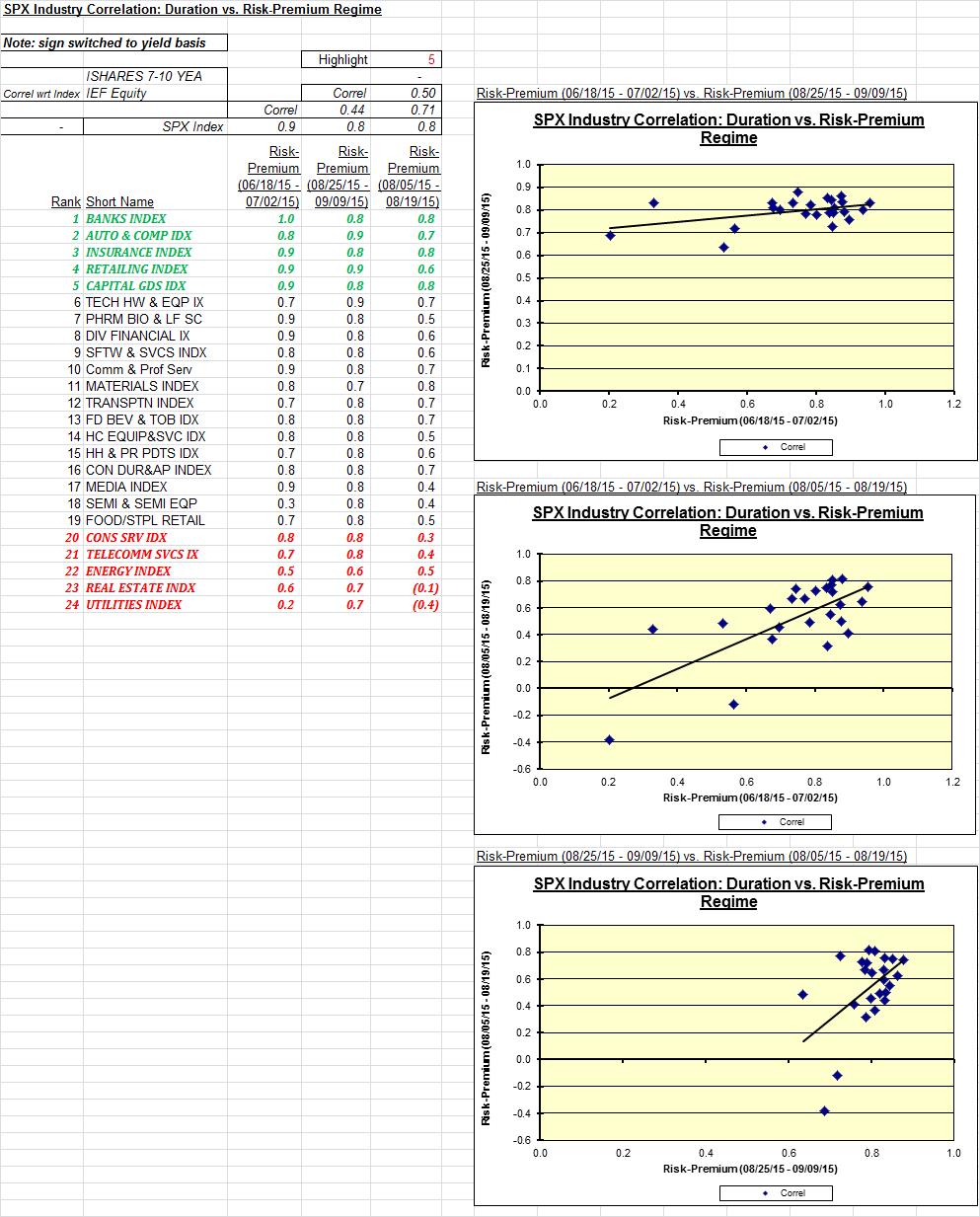

SPX industry response during recent risk-premium (on/off) regime periods:

Next, I attempted to discern if there were any consistent SPX industries that were most highly or loosely correlated with UST10y yields during these 3 most +ve episodic 10d correlation (risk-premium regime; SPX +ve/-ve as UST10y yield +ve/-ve) sub-horizons. These are aggregated using a composite ranking methodology and are displayed below and noted in the “punch line” above. Further, scatterplots of the industry correlations reveal a degree of consistency over the 3 different episodic 10d sub-horizons.

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors