Punch line: the following analysis illustrates the S&P 500 optimal sector allocation and sensitivity to correlation regimes. One takeaway that jumps out is the increased allocation to financials and energy, and reduced allocation to bond-proxy utilities and telecom services under the elusive “duration” correlation regime as the latter two sectors no longer provide a risk-reducing diversification benefit as sectors of all stripes respond in unison to the interest-rate brush.

Granularizing on the prior “Macro asset-class optimal portfolio allocation: correlation regime sensitivity,” the following analysis illustrates the S&P 500 optimal sector allocation and sensitivity to correlation regimes.

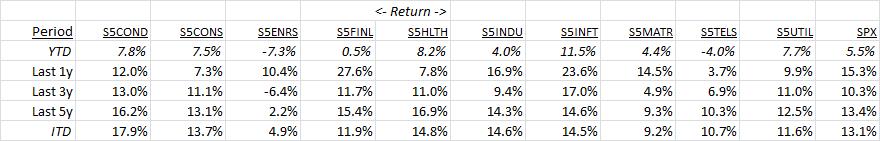

To set the stage, the following table displays S&P 500 sector returns over a variety of time horizons (spanning Jan 1, 2010 to April 17, 2016; post GFC drawdown and aftermath new-normal era; <=1y actual, else annualized, return; all with dividends):

Next, annualized volatility:

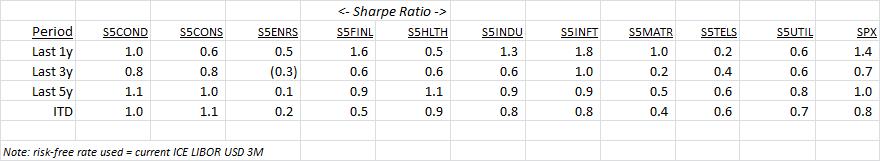

Followed, by Sharpe Ratio:

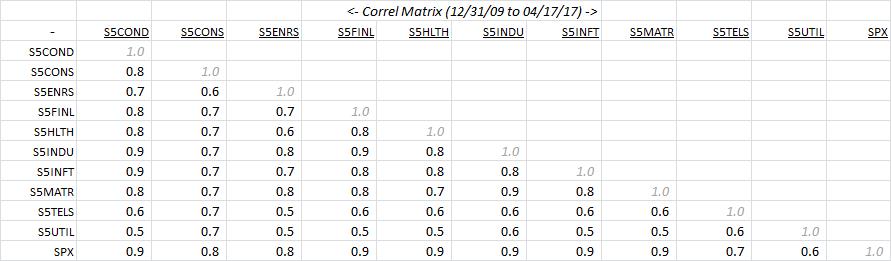

Finally, correlation:

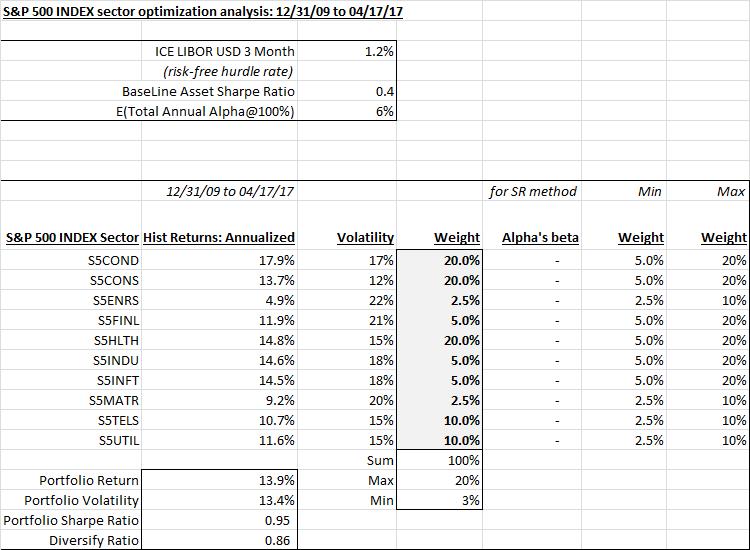

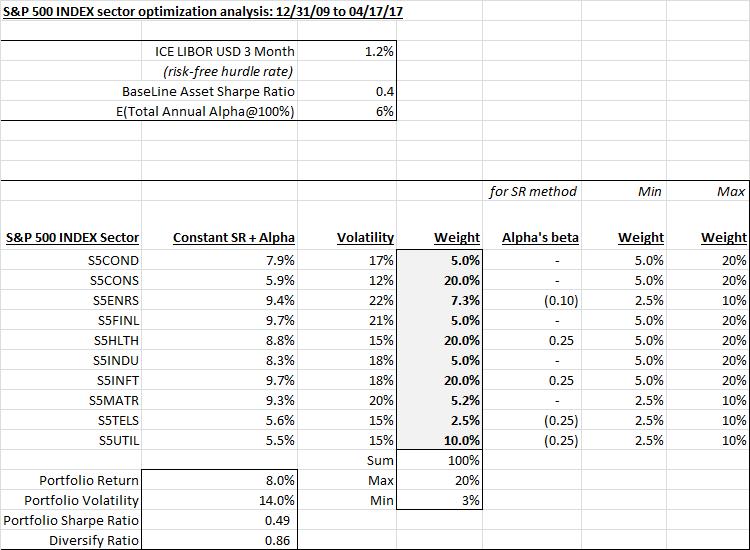

“Optimal” Allocation:

As a preface, this is an exercise fraught with non-trivial noise and many moving parts and dimensions. Any quantitative analyses can at best serve as a starting-point suggestion designed to be qualitatively and dynamically modified, and at worst is dangerous science. The quantitative guideposts below may help triangulate towards an efficient allocation solution:

- Using a traditional historical risk-return based mean-variance optimization, subject to min/max participation constraints, yields the following optimal allocation (grey highlighted box):

Essentially, the optimal allocation pushes to the boundary participation constraints with higher historical Sharpe ratio and lower-correlation strategies embraced and others shunned.

- One of the many weaknesses of traditional historical mean-variance solutions is the use of historical returns which can severely handicap the analysis (more on this below**). In order to address this and provide a forward-looking perspective I introduce the following innovations:

- ex-ante unbiased risk-adjusted return expectation: constant baseline Sharpe ratio across strategies of 0.4 (broadly consistent with Ibbotson’s ultra LT risk premium)

- incremental alpha component:

- expected total annual alpha, fully invested, of 6%

- alpha’s beta scales base alpha of 6% by a beta factor which is a qualitative adjustment to reflect propensity, past and future expectation, to generate incremental value added

Invoking the user-modified mean-variance optimization framework, subject to min/max participation constraints, yields the following optimal allocation (admittedly contrived via alpha’s beta):

Once again, the allocation largely pushes to the boundary participation constraints albeit with a markedly differential allocation to the prior historical run.

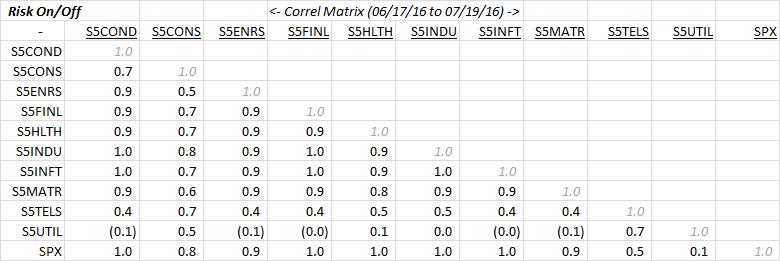

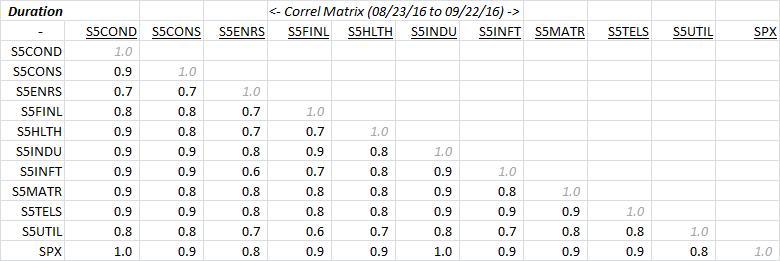

In order to illustrate the optimal allocation sensitivity to correlation regimes, I used the “risk on/off” and “duration” boundary correlation regimes from the prior “Macro asset-class correlation regime evolution” analysis to compute inter-sector correlation matrices realized over those date horizons. These are shown below:

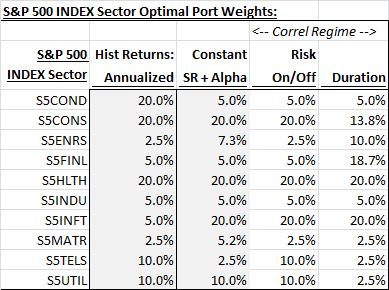

Throwing these boundary correlation matrices in the user-modified mean-variance optimization blender yields the following optimal portfolio allocations (with the prior two allocations shown alongside for comparison):

One takeaway that jumps out is the increased allocation to financials and energy, and reduced allocation to bond-proxy utilities and telecom services under the elusive “duration” correlation regime as the latter two sectors no longer provide a risk-reducing diversification benefit as sectors of all stripes respond in unison to the interest-rate brush.

**One of the soft underbellies of traditional mean-variance optimization solutions is the use of historical returns which tends to severely handicap the analysis (historical return may have no bearing on future return expectation; indeed, one may be long/short a historically under/out performing asset which might make optimization results stand on their head relative to future expectations). An unbiased innovation to address this is to rely on arbitrage logic that ex-ante all assets have the same expected risk-adjusted return (else the market would move into higher risk-adjusted return investments and away from lower risk-adjusted return investments so that in equilibrium all had equivalent risk-adjusted returns). Clearly, this proposition is more defensible over the theoretical long term and less granular level; hence, the incremental alpha and alpha’s beta value-added terms to subjectively qualify returns.

Please note the following, amongst other, caveats, qualifications and risk-factors:

- optimization results are horribly unstable and one may arrive at vastly different solutions by varying time horizons and covariance matrices; additionally, they suffer from the “egg-crate” problem where slightly sub-optimal solutions may have more intuitively-appealing results

- these guideposts, along with other related analyses and market barometers such as implied/realized correlation, dispersion, residual/specific risk etc., may help triangulate towards an efficient allocation solution

- any such “rules” are designed to be broken and dynamically modified based on the evolving, situation-specific market environment

Note: calculations Risk Advisors, data Bloomberg

Proprietary and confidential to Risk Advisors