Punch line: for a retirement longevity horizon of 30 years, and a 95% confidence threshold of not outliving your wealth (5% likelihood of wealth shortfall), the initial wealth corpus required is 31.1 times the target real annual spend.

Following my prior post – “Wealth longevity: how much do I need to retire?” – I received several queries on the initial wealth corpus required to sustain a target real annual spend over a given horizon, with a high degree of confidence.

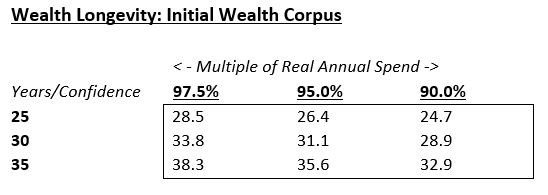

I used my retirement wealth-income simulation tool, subject to the myriad baseline input assumptions**, to provide an indicative solution set, displayed below. The vertical columns represent retirement longevity horizons; the horizontal rows represent confidence thresholds that funds won’t run out; the values in the matrix represent the multiple of target real annual spend required as an initial wealth corpus.

Thus, as an example, for a retirement longevity horizon of 30 years, and a 95% confidence threshold of not outliving your wealth (5% likelihood of wealth shortfall), the initial wealth corpus required is 31.1 times the target real annual spend (for an annual spend of $100,000, inflation-adjusted through time, the initial wealth corpus required is $3,110,000).

Repeating the parting caveat: the only certainty regarding the cherished nirvana of retirement is uncertainty. Using multiple quantitative frameworks, tire-kicking the assumptions, and complementing them with qualitative guidelines and considerations, can help triangulate towards making a better informed and more thoughtful retirement decision. And, very finally, recognizing that models make wonderful servants, yet terrible masters, flexibility and dynamic adjustment are paramount. Enjoy the golden years!

**

- expected portfolio return: 5.0%

- portfolio volatility: 7%

- expected Inflation: 2.5%

- inflation volatility: 1.25%

- portfolio-Inflation correlation: -0.25

Note: expected portfolio return assumes a modest premium to equilibrium nominal GDP growth, which in turn is a function of population growth, productivity and inflation; portfolio volatility pays homage to prior research on macro asset-class-based mean-variance portfolios; expected inflation is loosely based on LT inflation markets; inflation volatility is contrived to arrive at a not unrealistic +/- 2-sigma range; as is portfolio-inflation correlation reflecting inflationary regimes tend to be inauspicious for portfolio returns.

Note: calculations Risk Advisors

Proprietary and confidential to Risk Advisors